Deal or no deal? That has been the question on everybody’s lips for some time now. The UK keeps kicking the Brexit can down the road, but if and when Brexit does happen, and whether we leave with a deal or not, there is likely to be a significant Brexit impact on trading.

The UK election has been a historic one, having a massive impact on what happens regarding Brexit. With the Conservatives winning by a landslide victory, their top priority is to get Brexit done in 2020 any which way they can. This includes the real possibility of a no-deal Brexit.

Whatever the future holds, there are likely to be big changes afoot in how the UK trades with other countries, both within the Eurozone and outside it. For example, trade between Britain and France, our closest neighbour, will be impacted significantly in the event of a no-deal Brexit. France is important to the UK as it is the fourth largest export market for us, and the third largest e-commerce market. It also plays host to many international trade fairs, providing access to buyers across the globe. France also has the 6th largest world economy, meaning the spending power of its 64.7m population is significant.

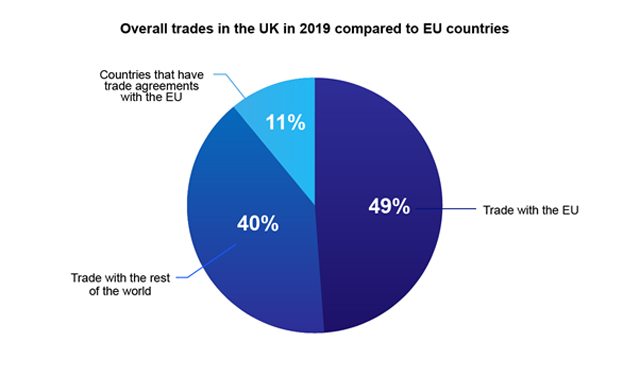

Currently, 49% of UK trade is within the EU, while 11% is with countries that have trade agreements with the EU, and 40% is with non-EU countries. If a no-deal Brexit occurs, the present EU trade agreements cease to apply. In countries where a trade agreement has not been signed, WTO (World Trade Organisation) rules will apply. This will mean the UK will be subject to tariffs, taxes and border checks that do not currently apply while we are an EU member state. The UK is currently still in discussions with some countries outside the EU, including Canada, Japan and Turkey, about how we will trade with them in the future. Some countries like Australia, New Zealand and the US have conformity assessments in place, where a mutual recognition agreement has been reached

The UK is currently seeking a bespoke trade deal post-Brexit, and rejects the idea that there are a choice of two options – a free trade agreement or becoming a rule taker like Norway, with full market access. The Canadian free trade agreement also seems an unlikely option, as it doesn’t cover the service sector, which accounts for 80% of the UK’s economy.

The EU has repeatedly said remaining in the single market to some degree is not an option. Some non-EU countries are an exception to the rule, but they have obligations to fulfil. Most others such as Ukraine are heading in the direction of joining the EU rather than trying to break away though, so the UK is in uncharted territory as the first country to try to leave the EU. The UK wants to avoid creating barriers to trade, but divergence from the current EU rules could introduce legal complexities that might deter other countries from trading with the UK. Therefore, the country could face some significant trade barriers with the 27 EU member states. If the UK wants to trade with them, it will need to accept the commitments tied to this.

The current deal that Boris Johnson put to the EU was accepted by them, however, it was voted out by the House of Commons. This means that trade agreements in the event of a deal is unclear, as a satisfactory deal has not been agreed yet. It is still unclear what the UK actually wants in terms of a trade relationship with the EU because it has only set out what it doesn’t want. It therefore needs to create a clear proposal that addresses the EU’s concerns around trading. The EU wants to establish negotiating guidelines by March 2020, which means the UK has a shrinking window of opportunity in which to negotiate, otherwise it may be forced to accept either one of the two options – adopt Norway’s rule taker stance, or accept a free trade agreement.

With so much to consider, and still no clear picture of exactly what the UK wants in terms of trade deals with the EU, the uncertainty looks set to continue for some months yet. Exactly what the impact of Brexit will be is still not fully understood. This makes life for businesses difficult and unpredictable, which is reflected in their fluctuating share prices. Some trading platforms such as eToro are therefore helping their investors to negotiate this particularly turbulent time, by establishing dedicated areas on their trading portals which provide updates on what Brexit means for clients’ trading. As the uncertainty continues, this type of information will no doubt be invaluable to those who want to maximise their assets and reduce exposure to risk.

The UK can’t formally agree its trade agreements. It is anticipated that deals with EU and non-EU countries will be struck from 2-10 years after Brexit. Some deals with countries like Israel, Faroe Islands and Switzerland will replicate the EU deals.

In the event of a no-deal Brexit, the EU may treat the UK as a Third Country, which means it will be subject to border checks, tariffs and taxes, at least until a trade agreement is reached.

Goods imported from the EU are likely to become more expensive, due to the tariffs imposed and different regulatory regimes. This could impact UK manufacturing, as components coming from the EU will cost more.

Hot Features

Hot Features