Financial markets continue to trade in the red zone as waves of uncertainty plague investor sentiment. The number of Coronavirus cases has crossed the 200,000 mark, with the pandemic spiralling out of control.

At the time of writing, major European indices such as the French CAC was down over 4% hovering around the 3829 mark, surprisingly the DAX recovered from earlier lows which saw the German index flirt around the 8400 figure and currently trading at 8602 – a similar trend seen in the FTSE which was down 134 points trading at 5160.

Governments across the West have promised to protect industry and commerce but Tuesday’s optimism was short-lived, with global markets trading in the red today and futures contracts on the main American indices triggering a circuit breaker.

Bail-out, bail-out and more bail-out

Governments around the globe have pushed toward fiscal stimulus. The Trump administration has assigned $1.2tn, the Spanish government €200bn, and the French government €45bn and the prospect of nationalizing troubled companies if needed.

However, US treasury secretary Steven Mnuchin said yesterday that the spread of COVID-19 could increase unemployment to 20%.

Oil tumbled to its lowest level in almost 17 years and is still under massive selling pressure. At the time of writing, the WTI is at 25.50, with a short-term target at 22. Saudi Arabia is planning to increase its oil export to a record 10 mln/barrels a day, which increases the negative view for the oil in today session.

Gold – typically seen as a safe haven – has failed to stabilize above the major levels at 1,535 and it is dropping toward between 1,480 and 1,460.

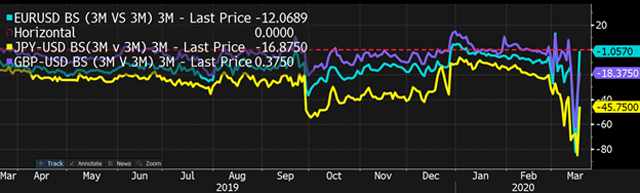

With the continued turmoil across most asset classes as funding is under strain and the demand for US dollar is increasing (as you can see from the cross-currency swap basis chart below), we believe the markets will continue to be under stress today.

This is likely to continue until we see a diminishing rate of the spread of novel COVID-19 – which is little to no sign of in the short term.

Source: Bloomberg

Written by Mohamed Zidan, Chief Market Strategist at ThinkMarkets based in Dubai, UAE.

Hot Features

Hot Features