Paranoia and fear continued to grip the markets last week as COVID-19 continued to spread, the death toll in Europe escalated dramatically, and economic activity across much of the world was disrupted to an extent unprecedented in the modern era.

Asian and European markets closed in the green on Friday after dramatic stimulus packages in both regions, but US equities declined on the close. The Dow Jones Industrial and S&P 500 both marked off their worst weeks since October 2008, a sign of the gravity of the situation.

Dow Jones lost 14% this week and closed below 20,000:

Source: Bloomberg

We’re anticipating the Dow Jones to continue to fall and hit the support levels of 18,500 and 18,200. While the huge interventions by the Fed and US government seem to have stemmed volatility, but it’s unlikely the bearish trend will stop any time soon.

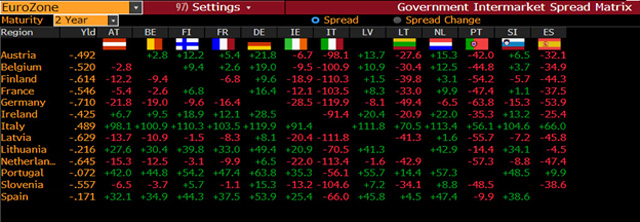

Meanwhile, the ECB has announced the launch of the Pandemic Emergency Purchase Program (PEPP) of €750 billion funding for asset-buying to counter the pandemic’s challenge to the monetary policy transmission mechanism. The ECB’s bond purchasing plans for 2020 run to €1.1 trn, the most ever.

This belated announcement calmed the European bond markets, with the spreads of two-year bonds narrowing.

Source: Bloomberg

Currencies

In the forex markets, EUR/USD last week fell to its lowest level since 2017, driven by the markets’ desire to hold US dollars.

As you can see in the daily chart below the down trend is more pronounced. Closing below 1.17 increases the probability of targeting the support at 1.055/1.050.

Source: ThinkMarkets

Europe

The EU has suspended the fiscal parameters of the Stability and Growth Pact, which should help governments make further large-scale economic interventions to manage the impact COVID-19 of the outbreak.

The German DAX which reached its lowest level since 2013 last week. It may have closed in the green on Friday, but this recovery is likely to be short-lived with the selling pressure and uncertainty continuing a fall to 7,500 is expected.

Source: ThinkMarkets

United Kingdom

In the UK, the Bank of England cut its base rate to 0.1% and added £200 bln. further to its quantitative easing (QE) program. This measure was taken after increased volatility in the gilt markets and the rapid fall of sterling as investors dumped UK assets en mase.

GBP/USD broke the major support levels of 1.20, and the bearish signal on the monthly chart below shows no sign of abating. This bearish setup and price action puts the level of 1.1 on the spot.

Source: ThinkMarkets

On the stock markets, the FTSE100 has plunged to its lowest level since 2013. We could see a rebound to resistance levels at 5,600 and 5,800.

However, the downtrend also is till on play and breaking 4,800 to target 4,500 and 4,200 is still a highly probable scenario.

Source: ThinkMarkets

Commodities

XAUUSD is still under pressure as markets seek out US dollars as a safe haven. Gold failed to close below 1480s levels and that suggests a rebound toward 1,555. On the other hand, after break below 1,480 levels we would expect another wave down toward 1,435.

Oil (WTI & Brent) is still suffering a double hit from collapsing demand and the Saudi/Russian price war. From a technical perspective, WTI stabilizing below 32 levels could be the ‘new normal’ and a downside break for the support at 28 would commence next week.

This leg down may target 25 and 22 levels.

What data are we waiting for this week?

Written by Mohamed Zidan Chief Market Strategist at ThinkMarkets a global CFD provider.

Hot Features

Hot Features