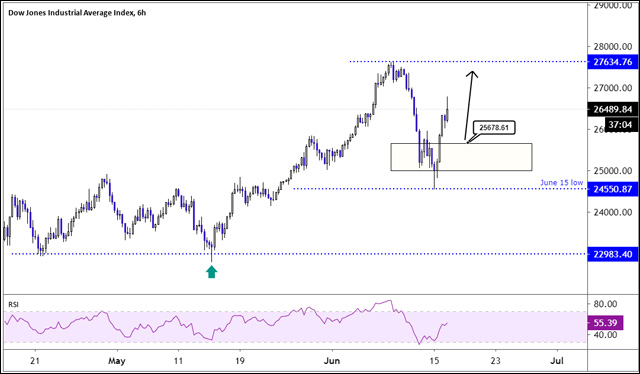

On Friday last week, I said that the Dow Jones remained bullish despite the 9.38% crash following fears of the second wave of coronavirus in the USA. The critical level to watch was the May 22 low of 24156. I also, said that I thought that the Dow Jones would carve out a low between the May low and the 50% correction level of the latest bull leg at 25190.

The Dow Jones traded as low as 24531 before turning higher. The market accelerated the upturn on news that the Federal Reserve added new measures to support US corporations. The Dow Jones reached a high of 1600 points from the buy-area with just a 650 points drawdown before the price traded higher.

The Fed will now directly buy corporate bonds in the second-hand markets, which will allow corporations to refinance at better interest rates if the Fed succeeds.

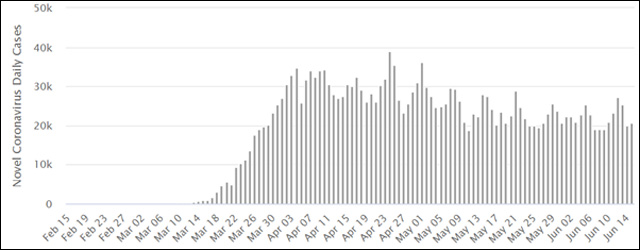

Also, on Monday, the new number of coronavirus cases was lower in the US compared with previous days, which further soothed trader’s nerves. According to Worldometers.info, the US-registered 20722 cases on June 15. My personal view is that we are not out of the woods yet, and we could see the pickup in cases in places like Florida, and California gain momentum. The next few days will give us a better understanding.

Daily New Cases in the United States

Dow Jones Technical Outlook

My new trend-defining level is this week’s low of 24550, and as long as the Dow Jones trades above this level the index might reach its June high of 27634.

Traders that are not already long will probably wait for a correction to the 24550-25678 interval to obtain a better risk-reward ratio before entering the markets.

If the trend fails, by the stock index sliding below this week’s low, the index might add to its losses, and I will turn neutral.

Dow Jones Six-hours Chart

By Alejandro Zambrano is the Chief Market Strategist at ATFX, and offers a premium trading course for traders that want to improve their trading.

Hot Features

Hot Features