In Q1 of this year the total market capitalisation of DeFi tokens stood at $84.6 billion representing approximately 50% of the total crypto currency market value.

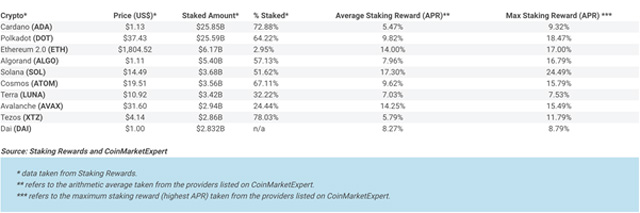

The explosive growth in DeFi has been driven by the attractive passive income opportunities, with popular crypto projects such as Cardano (ADA), Polkadot (DOT) and Ethereum 2 (ETH2) offering a annualised staking rewards of up to 9.32%, 18.47% and 17% respectively according to data from CoinMarketExpert.

According to the State of Staking Q1 2021 report published by Staked, over $20 billion was paid out to crypto investors last year in the form of staking rewards. The same report found that staking across different blockchains earned an average weighted annualised yield of 11.2%. That compares to a dividend yield of only 1.51% for S&P 500 Index and 3.8% for the FTSE 100 Index for the same period.

Crypto currencies are risky and highly volatile so by implication they should provide an elevated yield when compared to traditional stocks.

Projects such as Cardano, Polkadot and Ethereum are building valuable blockchain infrastructures that will likely become widely adopted by traditional industry. Also, professional investors who understand the future value of these projects are beginning to allocate a small percentage of their portfolios to crypto (circa 3% – 5% ), claiming crypto also provides diversification benefits.

Blackrock, one of the largest asset managers, has also started to dabble in bitcoin. As more professional investors start to dabble in crypto what do you think will happen to prices?

Crypto prices will continue to rise to higher levels over the long term and here are just a few fundamental reasons why:

- Increased institutional adoption: more asset managers are beginning to allocate small crypto exposures to their funds. Also the payments industry is starting to open up to crypto as well with Visa recently starting to accept USDC stablecoins. Other financial institutions are slowly following suit.

- Developing country monetary policy rehabilitation: Developing countries that have historically failed to produce a stable monetary policy system may adopt crypto currencies to help rehabilitate their economic system. El Salvador’s President Nayib Bukele recently passed a law making bitcoin legal tender. This will take effect on 7th September 2021.

- Central Bank Digital Currencies (CBDCs): Central banks are looking into digital currencies known as Central Bank Digital Currencies. This form of digital currency will probably require a blockchain infrastructure to operate on such as Ethereum.

- Bitcoin supply dynamics: Bitcoin has acted as a barometer for the wider crypto market, so when the price of bitcoin rises optimism tends to proliferate across other crypto assets. Since bitcoin was developed in a way that its supply (the supply of newly minted bitcoins to be precise) gradually diminishes over time basic economic principles dictate the price of bitcoin stands to increase further over the long run as demand (adoption) gradually grows.

The halving of bitcoin’s mining reward last occurred on 11th May, 2020, resulting in a block reward dropping from 12.5 BTC to 6.25 BTC. What this means is that whenever a bitcoin miner successfully mines a block, instead of receiving 12.5 newly minted bitcoins for their service, they now receive 6.25 bitcoins. The next bitcoin halving is expected to occur sometime in Spring 2024.

For reasons mentioned above, crypto investors may want to consider the current sharp pull-back in crypto currency prices as an opportunity to buy and hold (or ‘ HODL’ in crypto speech) for the long term – at least be prepared to buy and hold for the next 5 years.

But instead of just buying and holding crypto idle in a wallet why not consider putting it to good use by moving it to a crypto staking or crypto interest rate account?

Hot Features

Hot Features