The financial markets encompass a broad range of options for traders and investors. The premier UK exchange, the FTSE 100 index, is a market-capitalisation-weighted index featuring blue-chip companies in the United Kingdom. The UK100, a.k.a. FTSE 100 index, is our point of departure in this guide.

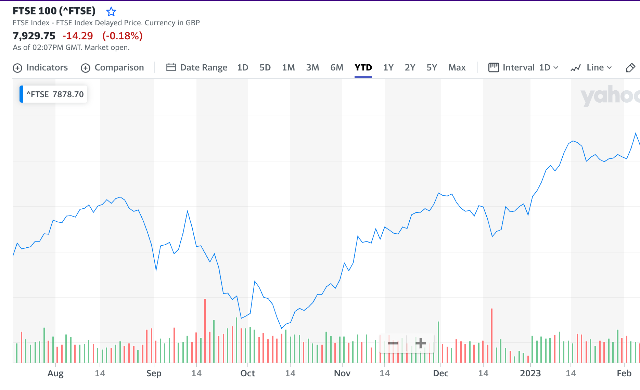

The Financial Times Stock Exchange Group (FTSE), is now known as the FTSE Russell Group. The FTSE 100 was created in 1984. At that time, the base level was 1000; today, the FTSE 100 Index level is hovering around 8000.

The index is a collection of blue-chip company stocks in the UK. There are many other indices in the UK, Europe, Australasia, the Americas, Africa, Latin America, and well beyond. The FTSE 100 index is the ranking shares trading market in the United Kingdom because of what it represents.

This top-tier index features publicly listed companies, but not just any companies – the 100 biggest and most successful blue-chip companies in the UK. Hence the name FTSE 100. The top 10 holdings in this particular index include the following:

- AstraZeneca (AZN)

- Shell (SHEL)

- HSBC Holdings (HSBA)

- Unilever Group (ULVR)

- BP (British Petroleum)

- Diageo (DGE)

- Rio Tinto Group (RIO)

- Glencore (GLEN)

- British American Tobacco (BATS)

- GlaxoSmithKline (GSK)

All indices in the shares market are dynamic. Publicly listed companies can rise and fall in the index, or drop out altogether. Your decision to trade shares online is based upon personal preferences, budgetary constraints, appetite for risk, and many other elements.

The actual trade – buying or selling shares – is straightforward. The challenge is the selection process, the trade’s timing, asset allocation diversity, and your comfort level. Today, we will explore tried, and trusted techniques traders use when learning how to buy shares.

The Simple Way to Buy Shares

Buying shares is a simple process but requires some knowledge and preparation. Therefore, before you start trading shares, you should consider the following aspects:

- Research and analysis: Research top-performing shares and read annual reports, financial statements, and news releases. Compare the historical performance of a company’s shares to others in the same sector. What brands are you most interested in? What companies do you support? That’s a good place to start.

- Choose a broker: Select a broker that suits your needs. Consider the services and fees offered by different brokers, from low fees but limited services to extensive research and analysis tools with higher fees.

- Decide on your budget: Determine your budget for buying shares, considering that share prices can be volatile. Invest only what you can afford to lose.

- Choose your shares: Select individual shares or invest in a managed fund. Know the details of the regular and blue chip companies you’re considering investing in, and diversify your portfolio to avoid putting all your eggs in one basket.

- Place your order: Provide the number of shares you want to buy and the price you’re willing to pay to your broker. The broker will execute the trade on your behalf.

Guide to Selling Shares

Knowing the right time to sell your shares is just as important as knowing when to buy them. Here are some key factors to consider when deciding whether it’s time to sell your shares:

- Performance: If a company’s shares have consistently underperformed, it may be time to sell. On the other hand, if a company’s shares have had a steady increase in value, you may want to hold onto them.

- News and events: When selling shares, it is important to consider the impact of significant news or events on a company’s share price. For example, a change in management, a major acquisition, or a new product launch can greatly influence the value of shares. If the news or event is negative, it may be a signal to sell your shares. But, if the news or event is positive, it may be worth holding onto your shares to benefit from any potential increase in value. Shares rise and fall daily – a function of demand/supply.

- Monitor market trends: Keep an eye on broader market trends, as they can be helpful in deciding when to sell. If the market is experiencing a downturn or volatility, it may be wise to sell some or all of your shares.

- Review your portfolio balance: Regularly review your portfolio to ensure it is aligned with your investment goals. If your shares in a particular company are over-represented, it may be a sign to sell some of them to maintain a balanced portfolio. The more concentrated your portfolio is, the greater your overall risk. It’s best to balance your portfolio to account for discrepancies, imbalances, weightings, and allocations.

- Consider personal circumstances: Your personal circumstances may also impact when you choose to sell shares. For example, if you need to raise funds for a major purchase, it may be necessary to sell some of your shares.

In general, it’s important to remember that no one can predict the market or individual stock prices with certainty. However, by keeping an eye on the factors outlined above and maintaining a long-term investment perspective, you can make informed decisions about when to sell your shares.

Closing the Deal

Investing in shares can be a lucrative way to grow your portfolio, but it’s important to approach it with caution and consideration. The markets are beholden to nobody, and they invariably do as they please, irrespective of the actions of participants.

Researching companies and their financial statements, choosing a reputable broker, diversifying your portfolio, and only investing what you can afford to lose are crucial steps in successful share trading.

With the right knowledge and preparation, you can begin trading shares and enjoy the benefits of long-term capital gains. So, take your time, do your homework, and make informed decisions when buying and selling shares.

Hot Features

Hot Features