Recent years have seen a string of crises that have affected the availability and prices of commodities across the board. The COVID-19 pandemic, mass lockdowns, the war in Ukraine, and climate change have all played a role in shaping the current state of affairs. In particular, concerns about the supply of soft commodities from the agricultural sector have been dominating headlines and attracting the interest of traders and investors.

Rice is one such commodity that’s currently in the spotlight. While Americans and Europeans may be more familiar with wheat, corn, and barley, rice is a staple food for over half the world’s population. Local rice production is vital for many rural communities across the Asia-Pacific region, while imported rice plays a significant role in food security for dozens of nations in Africa, the Middle East, and South America.

However, according to a recent report by CNBC, we’re now facing the biggest rice shortage in 20 years, with a global shortfall of 8.7 million metric tons. Recent weather phenomena, such as heavy monsoon rains and floods in China, severe flooding in Pakistan, and frequent droughts in the Lower Mekong Basin, have negatively impacted rice production.

So, what does this mean for investors? Well, the agricultural sector has traditionally been seen as a low-risk, low-return sector that lacks the glamor and potential rewards compared to other sectors or trading commodities. However, with the emergence of the food, commodity, and now the rice crisis, companies that specialize in agricultural technology and food technology are poised to revolutionize the industry and reap the rewards.

3 Agriculture Stocks to Consider

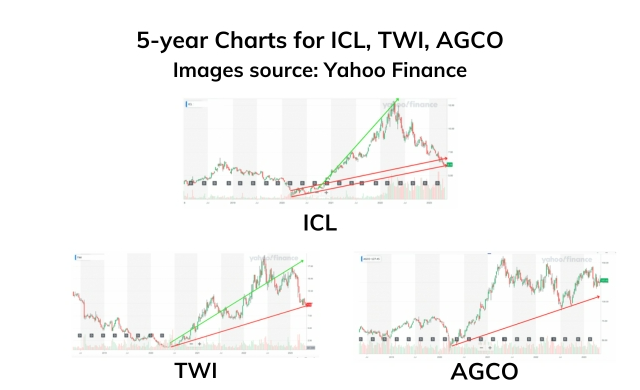

Here are 3 companies whose stocks in particular are worth checking out, Titan and Agco are agricultural equipment stocks, and ICL Group being a leading fertilizer manufacturer and offering innovative agriculture solutions to enhance crop yields and quality.

Let’s take a deeper dive into each one of these stocks.

1. ICL Group Ltd. (NYSE: ICL) (TASE: ICL)

ICL Group is a global specialty minerals company that belongs to the basic materials sector. It engages in the manufacture of mineral-based products for the agriculture, food, and engineered materials markets. ICL is recognized as a leading global supplier of potash and phosphate fertilizers, which are essential nutrients that help improve soil fertility and support plant growth. ICL products are used by farmers, agronomists, and food producers in over 100 countries, including major rice producers like China and India. In addition to its innovative fertilizer and crop nutrition solutions, ICL is committed to promoting sustainable agriculture practices. The company is working to reduce greenhouse gas emissions, conserve water resources, and minimize the environmental impact of its operations. Overall, ICL Group’s focus on producing and supplying essential products for the agriculture industry makes it a relevant company in the agriculture sector. ICL delivered some excellent YoY results in 2022 and 2023 with a record increase in revenues and a 185% increase in EPS from $0.64 to $1.82. ICL is a company to consider adding to one’s portfolio.

Technicals

The stock price is currently trading close to its 52 week low which is possibly a great entry point before it goes up again to its all time highs as it did in 2022, which can be seen on the 5 year chart above.

2. Titan Tire Corporation (NYSE: TWI)

At first glance, Titan might seem like an odd choice for anybody who is planning to invest in the agricultural sector. A closer look at the corporation shows that it acquired the iconic Goodyear Farm Tires in 2005. Titan had previously bought the off-road tire assets of the world-famous Pirelli Tire Corporation. The technological revolution that is quietly transforming the agricultural sector isn’t limited to field-side computer irrigation systems and smartphone apps that give farmers access to big data for growing solutions. Vehicles are a vital component of profitable agriculture and a company that can provide durable off-road tires to a new generation of smart agricultural vehicles has huge potential for growth. Titan has supplied tires to Caterpillar and John Deere and has an outstanding reputation. Titan is currently also rewarding its investors. TWI EPS grew from US$0.80 to US$2.79 in the space of a single year. This will be a hard number to sustain, but the company has great potential.

Technicals

This stock too seems to appear oversold, and perhaps making it an excellent entry point, in 2022 it made new highs as can clearly be seen on the 5 year chart above.

3. AGCO Corporation (NYSE: AGCO)

The Agco Corporation is an S&P 400 component company that manufactures a wide variety of agricultural machinery. Since its foundation in 1990, Agco has steadily expanded and acquired rival businesses. The corporation now has a global presence and annual revenues in excess of $12 billion. Agco-owned brands include Challenger, Fendt, and Massey Ferguson. Crucially for Agco, it is moving into the fields of robotics, software engineering, and associated high-tech enterprises. Given its massive resources and interest in emerging technologies, Agco is well-placed to cash in on the new agricultural revolution. The company is expected to be a leader rather than a follower when it comes to developing new generation autonomous farming equipment that can run on sustainable energy like green electricity, or even hydrogen. AGCO is a well-respected stock that is delivering a strong performance. AGCO EPS for Q4 2022 was $4.29, representing a YoY increase of 15.01%. Agco’s strong performance over recent years, worldwide reach, and its anticipated performance as a technical innovator make it an interesting investment choice.

Technicals

It is difficult to see from a technical point which direction this stock is heading right now, if it manages to revisit its recent highs it might be able to break out to new 52 week highs.

In Conclusion

The largest rice shortage in 20 years perfectly illustrates the need for technical innovation in every aspect of agriculture. It also shows the need for localized, field-based solutions that can help farmers adapt to climate change and deliver high yields of healthy crops. The agricultural sector is the most durable and dependable market in the world. People may stop buying luxury goods and reduce their consumption of non-essentials to a bare minimum, but they will always need food. Therefore, there is a need for companies that help feed the world by increasing yields.

There is a misconception that (outside the futures markets and specialist niches) the agricultural sector doesn’t generate high profits for investors. ICL, Agco, and Titan are just three companies that operate within the agricultural industry and ICL and Agco consistently pay respectable dividends on their stocks. This decade is expected to see an Agtech and Foodtech boom and a proliferation of new products and services. The stocks that we took a look at are potentially a great entry point for any investor who wants to explore the sector in depth, but as with any investment, it is important to conduct thorough research and analysis before making any investment decisions.

Hot Features

Hot Features