The UK SME sector faces significant challenges in managing digital services amidst an increasingly complex economic environment. As the UK Chamber of Commerce highlighted, SMEs struggle with capacity issues, resilience concerns, and security gaps regarding their digital tools.

However, amidst these hurdles, integrating fintech solutions and cryptocurrency exchanges, including the cheapest crypto exchange options, presents a unique opportunity for SMEs to thrive. This integration allows SMEs to enhance their digital capabilities, optimize resource allocation, and seamlessly integrate into cutting-edge markets for sustainable growth and success.

Challenges in Managing Digital Services

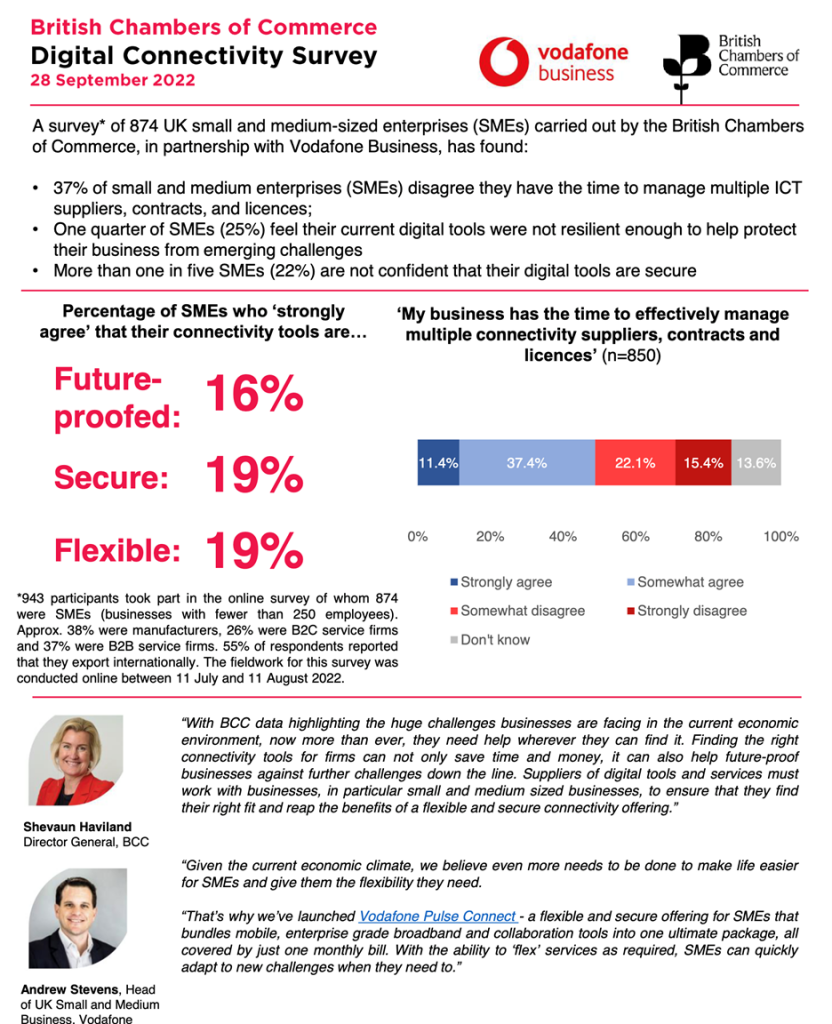

The UK SME sector faces significant challenges in managing digital services. Capacity issues pose a hurdle for many SMEs, as they lack the necessary resources and expertise to effectively handle multiple ICT suppliers, contracts, and licenses. This limits their growth potential and adaptability in the increasingly digital-driven business landscape.

Resilience concerns further complicate the situation for SMEs. Existing digital tools may not be resilient enough to withstand emerging trends and challenges, leaving SMEs vulnerable to disruptions, cyber threats, and financial risks. Maintaining operational continuity becomes a crucial aspect of their business sustainability.

Security gaps in digital tools raise concerns for SMEs as well. With the rising sophistication of cyber threats, SMEs must ensure the security and integrity of their digital infrastructure. However, a lack of confidence in the security measures provided by current suppliers puts their sensitive data, operations, and relationships with customers and partners at risk.

Overcoming Economic Challenges: Fintech Solutions for Resilient SMEs

Economic challenges can have a profound impact on the growth and sustainability of UK SMEs. However, in the face of these hurdles, fintech solutions provide a lifeline, empowering SMEs to overcome obstacles and emerge stronger.

By leveraging fintech tools and innovations, SMEs can enhance their resilience, improve cash flow, and optimize their overall operations, enabling them to navigate the challenging economic landscape with greater confidence and stability.

One key aspect of fintech solutions that benefit SMEs is the availability of streamlined payment systems. Traditional payment methods can be cumbersome and time-consuming, causing delays in cash flow and hindering business growth. Fintech solutions offer efficient and secure payment systems that enable SMEs to transact seamlessly with their customers and suppliers.

Whether through mobile payment apps, online payment gateways, or digital invoicing platforms, these tools facilitate faster and more convenient payment processes, ensuring that SMEs receive timely payments and maintain healthy cash flow.

In addition to payment systems, efficient financial management platforms are crucial in empowering SMEs to overcome economic challenges. Fintech solutions offer robust accounting software and financial management tools that allow SMEs to monitor their cash flow, track expenses, and generate accurate financial reports.

By automating financial processes, SMEs can streamline their financial operations, reduce manual errors, and gain a clear financial health overview. This real-time visibility into their financial status enables SMEs to make informed decisions, identify cost-saving opportunities, and allocate resources effectively, thereby improving their financial resilience.

Embracing Digital Transformation: Cryptocurrency Exchanges as Catalysts

Cryptocurrency exchanges have emerged as game-changers, revolutionizing the digital transformation journey for UK SMEs.

By embracing cryptocurrencies as a means of payment and investment, SMEs can unlock new opportunities in the global market. The secure and decentralized nature of cryptocurrency transactions offers SMEs enhanced security, streamlined processes, and the ability to seamlessly engage with international customers and partners.

Moreover, by adopting cryptocurrency exchanges, SMEs can access previously out-of-reach liquidity and funding options, enabling them to fuel their growth ambitions and expand their market presence.

Streamlining Operations: Fintech’s Role in Integration and Resource Optimization

UK SMEs must embrace fintech innovations that drive integration and resource optimization to stay competitive. Advanced analytics tools, AI-driven platforms, and automation technologies empower SMEs to make data-driven decisions, optimize resource allocation, and streamline operations.

By seamlessly integrating with emerging technologies, SMEs can boost productivity, drive innovation, and gain a competitive edge in the evolving market landscape. Furthermore, fintech solutions provide SMEs with real-time insights, enabling them to adapt to changing market dynamics, identify growth opportunities, and optimize their business strategies for sustainable success.

Source: British Chambers of Commerce Digital Connectivity Survey September 2022

Meeting Challenges Head On

In summary, fintech and cryptocurrency exchanges present unparalleled opportunities for UK SMEs. By harnessing these innovative solutions, SMEs can navigate economic challenges, drive digital transformation, and position themselves for long-term success in a rapidly changing business environment.

Embracing fintech and cryptocurrency exchanges is not just a choice but a necessity for SMEs looking to thrive in the digital era. By leveraging the power of fintech and cryptocurrency, UK SMEs can enhance their digital capabilities, optimize resource allocation, and seamlessly integrate into cutting-edge markets.

This ensures their growth and prosperity in today’s and tomorrow’s dynamic UK and global business landscape.

Hot Features

Hot Features