When it comes to investing in crypto, most traders will say how they prefer a diverse wallet over one that’s dedicated to a particular currency. The reasons for this can be wide and varied, but the general consensus is that it’s better to have fingers in multiple pies, as opposed to placing all eggs inside of one basket. One common question faced by traders when considering investing is which option is better – saving up for a high-cost cryptocurrency, or opting for a collection of smaller alternatives. In this post, we’ll be exploring the concept of both options.

What is High-Value Crypto?

Some of the most common include Bitcoin and Ethereum. These two cost thousands to purchase and so are considered some of the most financially valuable crypto on the market. They are also both diverse enough to be used as divisible currency, meaning that you can pay for goods and services with them, and they can even be used to purchase digital tools including online subscriptions as well as accounts with platforms that provide things like free text to speech tool, with options to pay for a full account after a subscription.

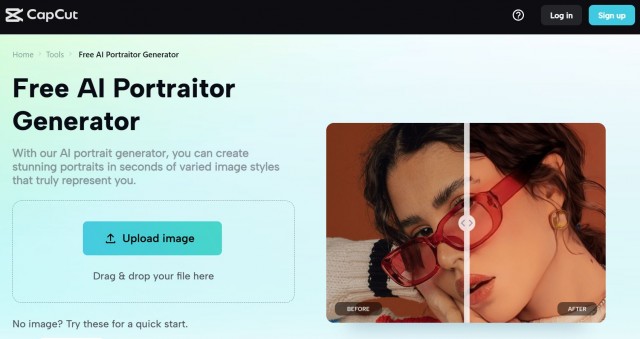

While we’re on this topic, CapCut just so happens to provide one of the highest quality text to verbal speech tools out there. It’s very simple to use and can be accessed directly from their website, where users can log in after setting up an account and then take advantage of the features and functions.

Text can be copied and pasted directly, or written via the input method available, and it will then be converted to speech and made available to download.

This is a great way to prepare for a presentation, and for those working in the crypto industry, it’s an excellent way to share messages anonymously with potential traders without having to expose oneself (which is a huge draw for crypto traders).

What is Low-Value Crypto

On the other side of the metaphorical coin is low-value crypto. This means that their market price is cheaper than high-valued currencies. Some of the most popular include Dogecoin (DOGE), Shiba Inu, XRP, and Cardano. These forms of crypto are cheaper than others on the market, but they still have a viable position for traders and offer their own unique benefits and rewards.

There was a story recently about an AI portrait generator tool being purchased using low-value crypto and after some further development, the tool went on to create several works of art that are showcased online. This is where the appeal of low-cost crypto comes into play. As their value (in USD) is considered low, they don’t need to be divisible.

For example, if purchasing a new car using crypto, a trader might have a variety of options if they diversify their wallet. Instead of using Ethereum (ETH), which has a higher yield than lower alternatives, they could opt to turn to their lower-valued currencies instead. They’ll be paying with more tokens, but they will also get to retain their higher-yield currency and nurture it as the value potentially increases.

Is a Diverse Wallet Recommended?

Yes, and the above example showcases exactly why it’s a good idea. Many people pay using crypto these days and the vast majority will have access to multiple types of currencies to choose from within their wallet. As the bigger names out there are often kept for long-term trades, there’s no harm in turning to the short-term solutions instead, I.e. Dogecoin or XRP.

By doing so, the purchase can still be made, but the main thing to consider is that the higher-yield currencies won’t need to be touched. The trade will take place in the same way, although the transaction fees might differ, but as the seller of the car might be happy to accept crypto in general as they’ll be converting it into their local currency anyway, such as USD, the concern isn’t really their one to worry about.

What’s more appealing is the fact that if the price of crypto does drop, it won’t be universal and will typically only affect one or two types at any given time. These can be traded off, or stored for a possible increase again, whilst other types may actually benefit from certain market fluctuations.

It’s worth keeping in mind that value doesn’t necessarily mean the price, although in this case it has been used as such. The price of a token is different to its value, in the sense that price dictates market value, as referred to in this article. Value from a trading perspective refers to the coins viability as an asset and how in demand it is. Both low and high valued coins (low price and high price) will have a market value, and a trader value, and so both of these options can be a viable solution for investors.

Hot Features

Hot Features