London open: FTSE gains as oil prices rise on Middle East tensions

London stocks gained in early trade on Wednesday, with oil prices on the rise as tensions in the Middle East escalated further.

At 0820 BST, the FTSE 100 was up 0.4% at 8,308.26.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “The FTSE 100 has headed higher in early trade, partly because of its defensive nature, helped by strength in energy stocks as oil prices continue their march upwards.

“As Iran’s cruise missile attack on Israel and fresh strikes on Hezbollah in Lebanon have unnerved investors. The uncertainty has made safe-haven assets like gold more popular, with demand for the precious metal ticking up close to record levels, as violence spills further across the Middle East, briefly climbing above $2,670 an ounce. Already sought after, amid concerns that inflationary pressures would persist, fresh geopolitical fracture has increased demand for gold. The dollar has steadied after gaining ground and US Treasuries proved more popular, indicated by falling yields, as investors have sought out trusted shelters amid the widening conflict.

“Oil prices are climbing, with Brent Crude approaching $75 a barrel, as supply concerns swirl again, sparked by heightened aggression. These worries are being mitigated by expectations that Saudi Arabia will turn on the taps more fully, and lower demand from China, but upwards pressure is likely to continue while uncertainty reigns about just how far conflict will spread.”

In equity markets, oil giants BP and Shell were among the top performers on the FTSE 100.

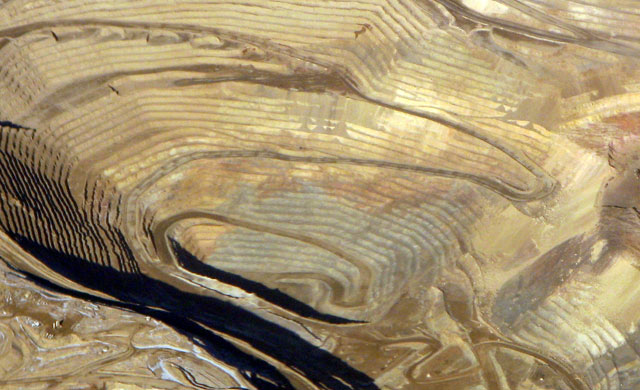

Heavily-weighted miners also advanced, with Rio, Anglo American, Glencore and Antofagasta all up.

Defence firm BAE Systems was also in the black amid escalations in the Middle East.

Saga surged after it confirmed it is in talks with Belgian insurer Ageas about a potential partnership arrangement for its insurance business.

On the downside, JD Sports Fashion slumped as it held annual guidance after delivering a 2% rise in half-year profit despite what it called a “volatile market”.

The company reported profit before tax and adjusting items of £405.6m for the six months to 3August, compared with £398m a year earlier. Revenue jumped 5.2% to £5bn.

The JD share price decline was likely due to negative read-across from Nike, whose shares fell sharply after the sportswear retailer withdrew its annual revenue forecast and posted a 10% drop in first-quarter revenue.

Top 10 FTSE 100 Risers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Prudential Plc | +3.64% | +25.20 | 716.80 |

| 2 |  |

Aib Group Plc | +2.74% | +11.00 | 413.00 |

| 3 |  |

Shell Plc | +2.60% | +64.50 | 2,542.50 |

| 4 |  |

Bp Plc | +2.52% | +10.10 | 411.10 |

| 5 |  |

Bae Systems Plc | +2.24% | +28.50 | 1,302.00 |

| 6 |  |

South32 Limited | +1.75% | +3.30 | 192.30 |

| 7 |  |

Hsbc Holdings Plc | +1.70% | +11.30 | 676.00 |

| 8 |  |

Woodside Energy Group Ltd | +1.65% | +22.00 | 1,354.00 |

| 9 |  |

Rio Tinto Plc | +1.26% | +67.00 | 5,365.00 |

| 10 |  |

Standard Chartered Plc | +1.13% | +8.80 | 788.00 |

Top 10 FTSE 100 Fallers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Jd Sports Fashion Plc | -4.95% | -7.40 | 142.10 |

| 2 |  |

Severn Trent Plc | -3.01% | -81.00 | 2,609.00 |

| 3 |  |

United Utilities Group Plc | -2.73% | -29.00 | 1,035.00 |

| 4 |  |

Vodafone Group Plc | -2.64% | -1.98 | 73.14 |

| 5 |  |

Sse Plc | -2.33% | -44.50 | 1,867.00 |

| 6 |  |

Carnival Plc | -2.24% | -27.50 | 1,198.50 |

| 7 |  |

Marks And Spencer Group Plc | -2.17% | -8.20 | 368.90 |

| 8 |  |

National Grid Plc | -2.05% | -21.50 | 1,026.00 |

| 9 |  |

Natwest Group Plc | -2.00% | -6.80 | 333.60 |

| 10 |  |

Sainsbury (j) Plc | -1.90% | -5.60 | 288.80 |

US close: Investors take profits as Iran sends missiles into Israel

US stocks fell on Tuesday, with the Dow and S&P 500 retreating from record highs and the Nasdaq hitting a two-week low, amid an escalation of conflict in the Middle East.

The Dow fell 0.4% and the S&P 500 dropped 0.9%, while the Nasdaq slumped 1.5% to 17,910.36 – its lowest close since 18 September.

Around 200 missiles were launched from Iran at Israel on Tuesday evening, according to a Pentagon report, which Iran said was a retaliation to the assassination of Hezbollah leader Hassan Nasrallah on Friday. Tensions were already high after Israeli troops crossed the border in southern Lebanon and continued shelling areas nearby along with airstrikes on the capital, Beirut.

Videos of Tuesday’s aerial strike quickly circulated across social media, as Israel warned of “consequences” in response. Iran’s Islamic Revolutionary Guard Corps said any retaliation would be met with “further crushing and destructive acts”.

Stocks fell sharply as reports came flooding in, while oil prices surged. West Texas Intermediate was up 3.9% at $70.75 a barrel by the close on Wall Street.

“The question is, will this blow over with little escalation, like it did in April, the last time that Iran launched missiles against Israel, or is this the start of a new, more dangerous chapter in the history of this conflict?” said Kathleen Brooks, research director at XTB.

Economic data barrage

A raft of economic indicators were scheduled for release on Tuesday, though market sentiment was being firmly dictated by ongoing developments in the Middle East.

The Institute of Supply Management’s manufacturing PMI fell slightly short of expectations for a reading of 47.5 in September at 47.2, continuing to point to a contraction in the manufacturing sector as demand continued to be weak and output fell.

The S&P Global’s manufacturing PMI was revised slightly higher to 47.3 in September, up from a preliminary reading of 47 but was still the lowest reading seen since June 2023.

Construction spending decreased by 0.1% in August to a seasonally adjusted annualised rate of $2.13trn, according to the Census Bureau, following a revised 0.5% drop in the previous month and missing forecasts for a 0.1% increase.

Finally, job openings rose by 329,000 to 8.04m in August, according to the Bureau of Labor Statistics’ JOLTS report, following an upwardly revised reading of 7.71m in July and above market expectations for a print of 7.65m.

Market movers

Chevron was among the few risers of the session as the oil major followed crude prices higher, along with Exxon Mobil, Occidental Petroleum and ConocoPhillips.

Boeing was also outperforming on reports it is considering raising at least $10bn by selling new stock as it looks to replenish cash reserves depleted further by an ongoing strike. Bloomberg cited people familiar with the discussions as saying that Boeing is working with advisers to explore its options.

Tech heavyweights were under heavy selling pressure during the session, with Intel, Apple and Microsoft among the worst performers. XTB’s Brooks suggested tech stocks were bearing the brunt of a flock to safety.

“While there is no obvious reason why US tech should sell off on the back of Middle East tensions, it could be a rapid reallocation of resources to safe havens, in case this leads to a prolonged conflict in the region,” she said.

Wednesday newspaper round-up: CityFibre, Covid loans, FCA

Ministers are being asked to draw up billions of pounds in cuts to infrastructure projects over the next 18 months despite Rachel Reeves pledging to invest more to grow the economy, the Guardian has learned. Members of the cabinet have been asked to model cuts to their investment plans of up to 10% of their annual capital spending as part of this month’s spending review, government sources said. – Guardian

The Irish finance minister has hailed the €14bn tax windfall from Apple as “transformational” just weeks after the government lost a case in the European court of justice arguing the tech company should keep its money. Unveiling the country’s budget on Tuesday, Jack Chambers said the money would be used on infrastructure and not splurged on giveaways before the general election, which is expected in November. – Guardian

BT rival CityFibre has warned it must raise more money to survive as the rising cost of its broadband rollout pushed debts above £3bn. The company, which is the largest of the so-called “alt-net” broadband firms taking on BT’s Openreach, said there was “material uncertainty” about its ability to continue because it was reliant on further external funding. CityFibre, which is backed by Goldman Sachs and Abu Dhabi sovereign wealth fund Mubadala, secured £4.9bn in debt financing from banks two years ago to help fund its network build. – Telegraph

Most businesses that received government grants during lockdown would have survived without the handouts, an official report has concluded. A report published by the Department for Business and Trade suggested “only a quarter” of the 1.4m businesses that benefited from £23bn of Covid-era grants would have gone bust without state support. The 100-page document concluded that “a relatively high share of the businesses supported would have been likely to survive without cashflow support – implying that the outcomes associated with the programme could potentially have been achieved with lower levels of public spending”. – Telegraph

A pressure group pushing for higher standards in finance has accused the Financial Conduct Authority of “peddling a false narrative” at its online annual meeting last week and called for a return to face-to-face meetings. The Transparency Task Force (TTF) has written to Ashley Alder, the FCA chairman, and Nikhil Rathi, the regulator’s chief executive, accusing FCA officials of misleading the audience over the investor protection regime. Remarks made at the meeting were “factually inaccurate”, it said. – The Times

Hot Features

Hot Features