The USDCHF pair recorded a small daily gain on Monday and entered the consolidation phase on Tuesday, as the markets seem to be already in a festive mood. At the time of writing, the pair remained unchanged at 0.9817 level.

Key Levels

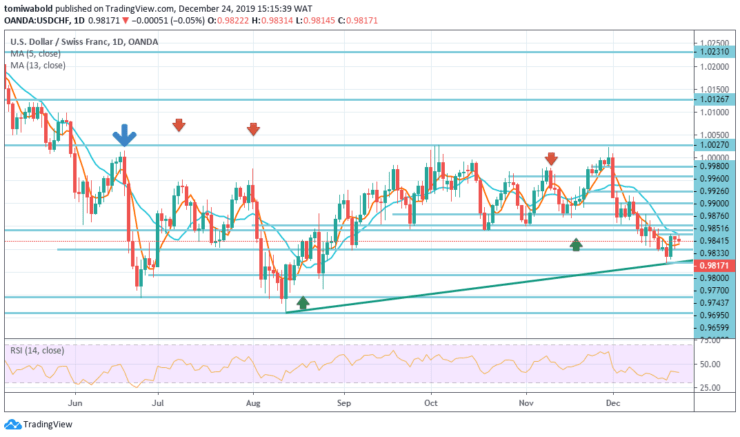

Resistance Levels: 1.0231, 1.0027, 0.9876

Support Levels: 0.9770, 0.9659, 0.9541

USDCHF Long term Trend: Ranging

In the long run, the long-term trend remains neutral, while the USDCHF is trending in the range of 0.9659 / 1.0231. In any case, a decisive breakthrough of the level at 1.0231 is necessary to indicate the resumption of an uptrend.

Otherwise, trading with a large range may be registered with the risk of another fall. Meanwhile, a break of the support level of 0.9695 may try to break through the support level of 0.9541.

USDCHF Short term Trend: Bearish

USDCHF remains in the range of the level at 0.9770 and its intraday bias remains neutral. An even greater fall is expected as long as the resistance level of 0.9876 holds.

On the other hand, below the level of 0.9770, a fall from level 1.0027 may again be activated and approach the minimum level of 0.9659. Although a breakthrough of the level at 0.9876 can change the bias back to the side of increasing the resistance level at 1.0027.

Instrument: USDCHF

Order: Sell

Entry price: 0.9833

Stop: 0.9876

Target: 0.9695

Source: https://learn2.trade

Hot Features

Hot Features