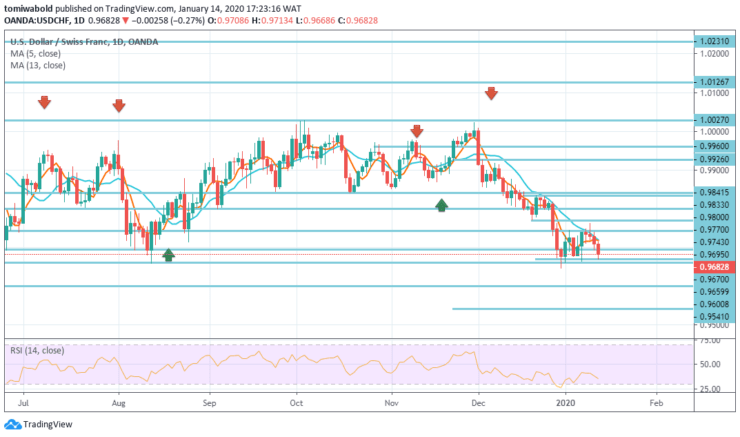

Key Levels

Resistance Levels: 1.0231, 0.9841, 0.9770

Support Levels: 0.9659, 0.9600, 0.9541

USDCHF Price Analysis – January 14

At the time of composing, the FX pair was trading at 0.9683 level, dropping 0.25% per day after discovering support around 0.9670 level. The USDCHF pair recovered its daily losses and was last seen trading at 0.9683 level, where it remained virtually unchanged during the day.

USDCHF Long term Trend: Ranging

The trend stays neutral because the USDCHF is actively in the trading range, starting at 1.0231 level(high). The fall from the level of 1.0126 is held inside the pattern and may approach the level of 0.9600 (low).

In case of another increase, a breakthrough of the level at 1.0231 is required to indicate the resumption of an uptrend. Otherwise, further trading by the range may be recorded with the risk of another fall.

USDCHF Short term Trend: Bearish

USDCHF today drops significantly but stays above the level of the temporary low of 0.9659 level. Its intraday bias stays neutral initially. Although at a resistance level of 0.9770 intact, this trend stays bearish and a steady decline is anticipated.

On the other hand, a breakthrough of the level at 0.9600 can continue the general decline from the level of 1.0231 and approach the 100% forecast of the level at 1.0231 to 0.9659 from 1.0027 to 0.9600. However, on the other hand, a break of 0.9770 level may indicate a short-term decline and a change in the upward bias.

Instrument: USDCHF

Order: Sell

Entry price: 0.9680

Stop: 0.9770

Target: 0.9600

Source: https://learn2.trade

Hot Features

Hot Features