Oil prices started on a sour note in the last week of April, dropping over 8 percent during Monday’s session on sustained over-supply fears. A barrel of the North American benchmark, West Texas Intermediate (WTI), is losing value close to $14.50 level, marking an 8.85 percent decline on the day.

Key Levels

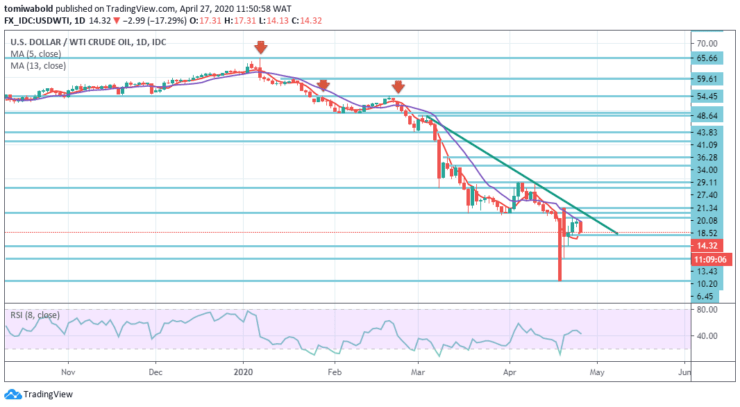

Resistance Levels: $21.34, $20.08, $18.52

Support Levels: $13.43, $10.20, $6.45

USDWTI Long term Trend: Bearish

The moving average of 5 and a multi-day sliding trendline, around $18.52 and $20.08 levels simultaneously, tend to barricade the potential upside to the oil benchmark. While level $10.20 stays on the watchlist of the bears throughout the ongoing price falls.

After demonstrating three days in a row of reversals, June’s WTI futures decline 8 percent to a level of $14.50 before continuing into Monday’s European open. Producers will temporarily shut down the supply to balance the lack of demand which may cause more market instability as price swings to the downside before supply equals demand.

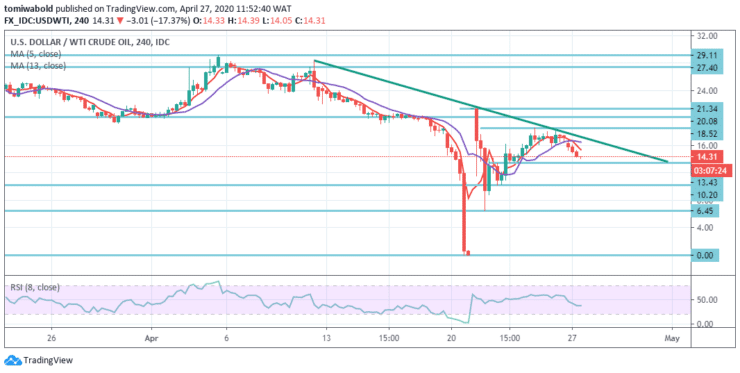

USDWTI Short term Trend: Bearish

WTI price action is currently trading at a $14.50 level beyond the near-term lower end of the range at $13.43 level. With the upward level of resistance shown at $18.52 in the near term, analysts expect prices to trade within that range.

On the upside, a break beyond $18.52 level would see oil prices challenging the $20.08 psychological level of resistance. Prices are somewhat likely to stay subdued in the short term and risk selling pressure, particularly with the storage concerns now lingering.

Source: https://learn2.trade

Hot Features

Hot Features