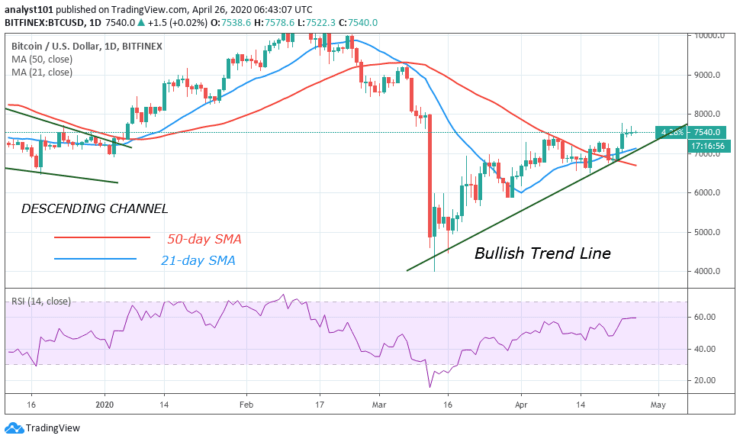

Key Support Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Bullish

Bitcoin is still consolidating above $7,500 since March 23. The price action is characterized by small body indecisive candlesticks. The candlestick indicates that buyers and sellers are undecided about the next move of the coin. On the upside, if the market decides to go up above $8,000; the momentum will extend to $9,000.

The $8,000 resistance is regarded as the major resistance to be crossed. Bitcoin will have move avenues for price rallies. Conversely, if BTC faces rejection, its initial drop will be to a low of $7,200. Subsequently, the downward move will extend to either $6,800 or $6,600 low.

Daily Chart Indicators Reading:

Bitcoin’s recent upward move rises to level 59 of the Relative strength index indicating that the coin is in an uptrend zone. The RSI is currently flat as the sideways trend continues. It is also above the centerline 50. The moving averages have indicated a bullish crossover.

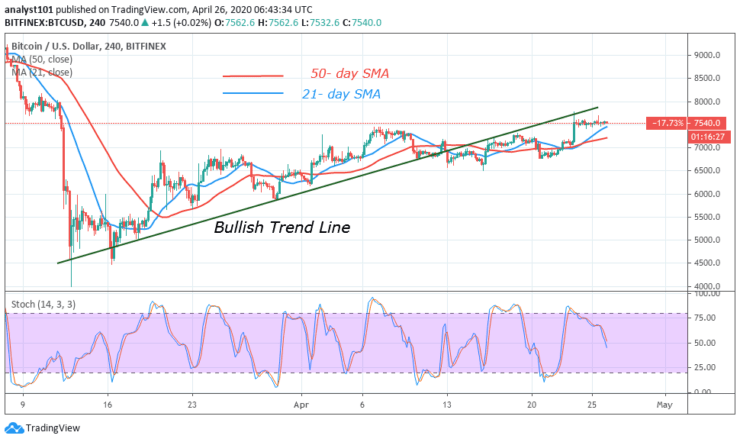

BTC/USD Medium-term Trend: Bullish

On the 4– hour chart, the price spike reached the trend line and pulled back above $7,500. The market is fluctuating above 21-day SMA and 50-day SMA. At the end of consolidation, price may break below SMAs or the SMAs may hold. BTC may fall, if it breaks below the SMAs. However, the uptrend will resume, if the SMAs hold.

4-hour Chart Indicators Reading

The market reached the overbought region after the price spike. BTC is below 80% range of the daily stochastic. This is in contradiction to the price action as the market is still consolidating. The SMAs are sloping upward.

General Outlook for Bitcoin (BTC)

Bitcoin is still above $7,500, sustained by small body candlesticks describing the indecision of buyers and sellers about the direction of Bitcoin. However, there is a bearish signal of its impending fall.

Source: https://learn2.trade

Hot Features

Hot Features