Following yesterday’s profit-taking-triggered slide to the $1,940 area, the yellow metal was quick to bounce back and is set to end the week in a grand style. The bull run marked the tenth consecutive bullish session in the past eleven days and was mainly bolstered by the dominant bearish sentiment surrounding the US dollar.

Worries over the dwindling prospects for an economic recovery amid the Coronavirus saga continued to exert strong bearish pressure on the USD. This worry was reignited following the release of the US Q2 GDP report yesterday, which indicated that the economy contracted by a record 32.9% annualized pace. This coupled with the political tussle over the next round of stimulus measures further weakened the USD and bolstered the dollar-denominated commodity.

This comes on the heels of the dovish FOMC comments earlier this week coupled with the prevailing drop in the US Treasury bond yields, which further strengthened gold’s bullishness.

Moving on, market participants will be looking at the US economic docket—which features the Core PCE Price Index, Personal Income/Spending data, Chicago PMI, and Revised Michigan Consumer Sentiment—for clues to trading opportunities today.

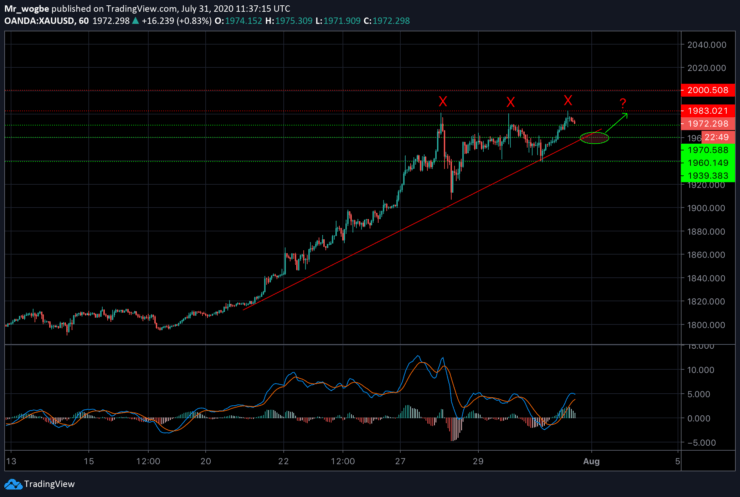

Gold (XAU) Value Forecast — July 31

XAU/USD Major Bias: Bullish

Supply Levels: $1,983, $1,990, and $2,000

Demand Levels: $1,970, $1,960, and $1,940

Gold has been progressing with our projections so far and is nearing the $2,000 target more and more. Immediate support can be found at the $1,970 level, however, further retrace will be strongly supported by the $1960 region, which happens to be a confluence of a support line and our ascending trendline.

At this level, gold needs a bounce from one of these support lines to send it once again on its journey to the $2,000 level, but first, we need to clear the $1,983 resistance.

Source: https://learn2.trade

Hot Features

Hot Features