Key Highlights

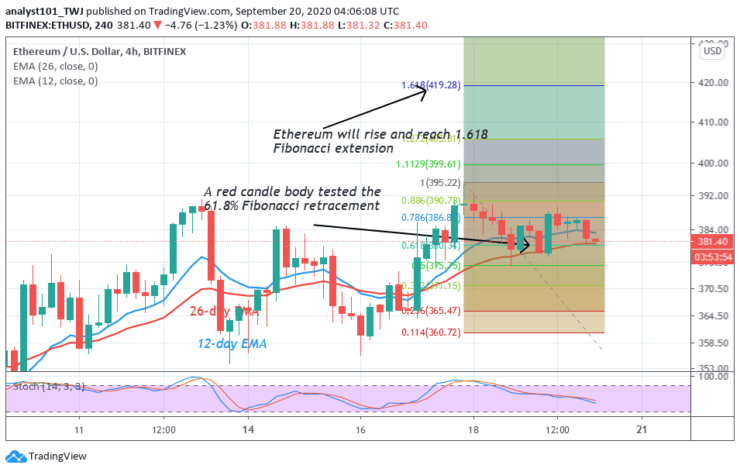

Ethereum has a fresh target price of $420

The coin is still battling the resistance at $390

Ethereum (ETH) Current Statistics

The current price: $381.78

Market Capitalization: $43,016,171,550

Trading Volume: $12,067,100,125

Major supply zones: $280, $320, $360

Major demand zones: $160, $140, $100

Ethereum (ETH) Price Analysis September 20, 2020

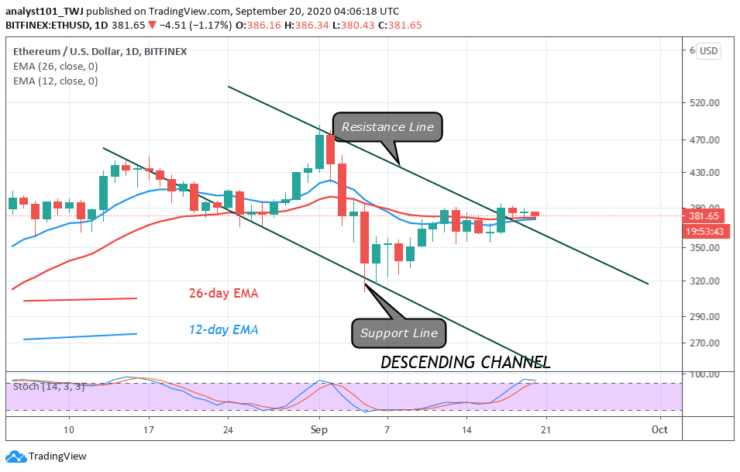

From the rejection at the $390 resistance, Ether is falling to the previous low at $378. Each time the market falls it will retrace to the low of $378 and $381. ETH will rise again to retest the $390 resistance. The coin is rising and it has reached $381 at the writing. The crypto has resumed an upward move as it found support above $380. On the downside, if price has retraced and broken below $350, the selling pressure would have persisted.

ETH Technical Indicators Reading

The price has earlier broken above the resistance line of the ascending channel. This assures that the rise of the coin will continue. Another aspect is that price has remained above the EMAs. This also indicates that the coin is rising.

Conclusion

From the price action on the 4-hour chart, Ethereum is likely to rise if the current resistance is breached. On September 17, the coin was in an upward move. It was resisted at $390 but the last retraced candle tested the 61.8% Fibonacci retracement level. This indicates that the market will rise and reach a high of 1.618 Fibonacci extension level or $420 high.

Source: https://learn2.trade

Hot Features

Hot Features