EURUSD Price Analysis – October 26

Growing fears of a surge in Europe Covid-19 cases may slowdown economic recovery as new infections trigger stricter measures and prompt investors into safety. EURUSD risks a deeper decline at the 1.1800 level as buyers repeatedly failed to make a sustained break above the daily cloud top around the 1.1850 level.

Key Levels

Resistance Levels: 1.2150, 1.2011, 1.1917

Support Levels: 1.1807, 1.1612, 1.1422

EURUSD Long-term Trend: Ranging

EURUSD Long-term Trend: Ranging

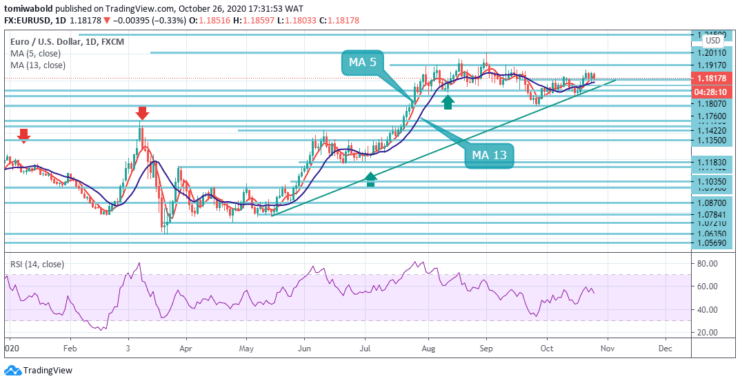

EURUSD is under pressure, trading near the 1.1810 level, and is in danger of further falling. The EURUSD rally appears to have hit a decent barrier at recent highs around 1.1880. A break of this area is expected to push the pair higher towards the 1.1917 area as the bullish trend is expected to resume at the key level.

In a broader context, the rise from 1.0635 is seen as the third phase of the pattern from 1.0339 (low). A further rally towards the cluster resistance at 1.2011 can be seen. This will remain a preferable case as long as the resistance at 1.1422 is held and turned into support.

EURUSD Short-term Trend: Ranging

EURUSD Short-term Trend: Ranging

EURUSD intraday trend stays neutral as consolidation from 1.1880 regions continues. Nevertheless, further growth stays in favor while maintaining the support level of 1.1685. The break into 1.1880 regions will be a test at the 1.2011 high. The 4 hours chart shows that the pair is developing below the moderately bearish 5 and 13 moving averages.

A move below 1.1800 is needed to mark an immediate (minor) high for a pullback to the bottom of the short-term channel seen at 1.1725. On the other hand, a breakout of 1.1685 is likely to extend the corrective pattern from 1.2011 by one more phase. Intraday bias will return to the downside towards 1.1612 and below.

Source: https://learn2.trade

Hot Features

Hot Features