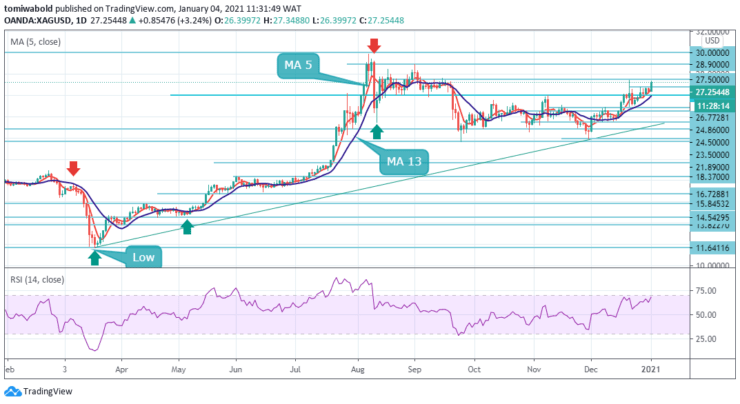

Spot silver (XAGUSD) is looking to break the $27.50 level as the white metal breaks out of its recent high of $26.77 during Monday’s early European session. Overall, the market remains patchy, but the dollar as a whole is weakening as markets wait to see what happens with US fiscal stimulus and Georgia’s run-off on January 5.

XAGUSD Price Analysis – January 6

Key Levels

Resistance Levels: $30.00, $28.90, $27.50

Support Levels: $26.00, $24.50, $23.50

XAGUSD Long term Trend: Bullish

XAGUSD Long term Trend: Bullish

XAGUSD price has convincingly broken to the upside of its range and the main resistance level to watch out for is the $27.50 that has capped its upside since 15th September. To the downside, the previous top of the old December range at around $24.86 level ought to offer immediate support, in case of an unexpected decline.

Alternately, if the $27.50 level gives way then silver prices could be looking towards posting further gains in the medium to long term. Price action has been broadly consolidating near the $26.00 levels over the past few sessions. If it does break above, a gradual move towards the mid-September highs above the $27.50 level will be likely.

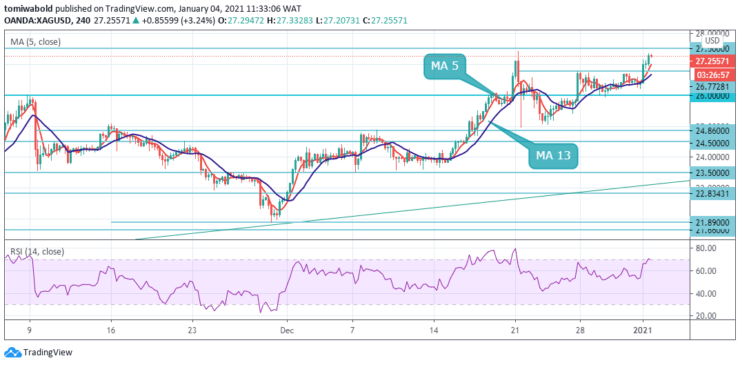

XAGUSD Short term Trend: Bullish

XAGUSD Short term Trend: Bullish

As seen on the 4-hour chart, silver appears to be launching toward a major technical barrier at the $27.50 level. In the event, the barrier holds intact XAGUSD is likely to gain support from 4 hours moving an average of 13 near the $26.77 level and return to extend gains against the US Dollar in the short term.

A possible upside target is the upside range at $28.90 and $30.00 levels, in the meantime, it is unlikely that bears could prevail in the market. That said, a sustained break below will be seen as the first signs of bullish exhaustion and turn the pair vulnerable to fall further towards challenging the key $24.50 psychological mark.

Source: https://learn2.trade

Hot Features

Hot Features