The cryptocurrency debit card is a type of debit card that allows holders to purchase and pay for services in real time using their crypto assets. These cards function like normal debit cards.

These cards are connected to crypto wallets or online accounts where cryptocurrencies are stored. They convert the usual currency to the token that is contained in them until the holder or user is ready to spend them.

Cryptocurrency debit cards give holders the chance to easily spend their crypto holdings the way they spend fiat currency. One can see them as gift cards that contain crypto instead of cash.

A list of the very best of these cards for this year (2023) has been compiled for you below.

Coinbase Debit Card

The Coinbase crypto debit card allows the holder to spend cryptos such as Ethereum and Bitcoin anywhere Visa debit cards are accepted for payment. Visa debit cards accepted for payment at more than forty million merchants globally. Coinbase debit cards do not charge transaction fees or yearly membership fees. It has a very simple reward framework, capped by just spending limits.

The point of attraction of this debit card is that it is tied to one of the most famous cryptocurrency exchanges in the world. Coinbase debit cards are linked with the holders’ Coinbase account, which is where funds are deducted. One can start using the debit card by simply opening an account with Coinbase or downloading the app. Such an individual will then load the app or account with his or her crypto, and make a request for the debit card.

Advantages

Coinbase debit cards have top-notch security.

Users get cashback rewards.

It supports more than 230 cryptocurrencies.

It doesn’t attract annual or transaction charges.

Disadvantages

If holders are not using USDC, they are charged a 2.49% fee for the conversion of their token to the dollar.

Individuals who wish to use the Coinbase debit card must open an account with them.

They require KYC.

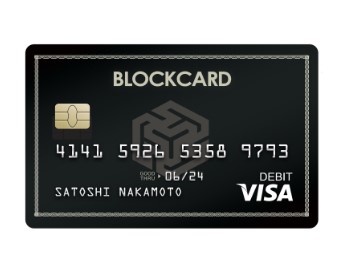

Blockcard Debit Card

This debit card was introduced by Ternio, and they provide virtual or physical debit cards that function with Samsung, Apple, and Google Pay.

To start using this debit card, one will have to register, make a deposit, complete the KYC check, and then supply funds to the account. In the process of finding this debit card, use any of the 14 supported cryptocurrencies. The used crypto is converted to Ternio tokens (TERN). Users can then stake these tokens to increase their cashback rewards to about 6% (145,000) TERN staked).

This token does not allow users to hold their funds in Ethereum or Bitcoin until they are ready to use them. Users are therefore advised to understand TERN’s price history before investing in it.

Advantages

Supported cryptocurrencies include Bitcoin, Ethereum, Litecoin, and USD (Fiat currencies) too.

Users can get cashback rewards as high as 6%.

It supports about 14 cryptocurrencies.

Disadvantages

Users will have to convert their token to the TERN token, which has not been stable in terms of value going by history.

Users are charged a $5 monthly fee and transaction fees.

Blockcard debit card services are only available in the United States.

Wirex Debit Card

Wirex is a company located in the United Kingdom, and they provide debit cards for personal businesses. They provide users with contactless cards and an application to operate them.

Wirex’s major product is its Visa card, which facilitates the conversion of fiat currencies and cryptocurrencies. Also, this card has generous rewards, and a lot of people see it as one of the best perks like the Wirex X-tras, through which users can get up to 8% cryptocurrency cashback. This implies that users get 12% as their saving bonus on their Wierx X-tras account. Other benefits of using a Wirex debit card include having access to a wide range of crypto and having free or very low charges.

Advantages

They don’t charge monthly maintenance fees and only attract 1% funding charges.

Users have access to cashback rewards.

It’s very easy to use.

It also supports 41 different cryptocurrencies.

Disadvantages

Wirex isn’t available worldwide.

Their rewards program charges are costly and may outweigh other benefits.

To get the best rewards, users need to possess Wirex tokens.

Bitpay Debit Card

This is an American company that offers Bitcoin merchant processing services, as well as Bitcoin payment processing solutions to businesses. Bitpay supports 15 different cryptocurrencies and can process cryptocurrency transactions within and outside of America, as long as MasterCards are accepted by the processor.

Bitpay users can also enjoy cashback rewards with more than 100,000 merchants. However, some rewards differ. from one merchant to the other. The Bitpay debit card is linked to one’s wallet via the Bitpay application. One can then fund the debit card through the application to spend in crypto.

Advantages

It charges no exchange fees in the United States.

It also does not charge yearly fees.

It also does not have a withdrawal limit.

Disadvantages

These services are only available in the United States.

Deposited cryptocurrencies are converted to the US dollar and can’t be converted back to crypto.

It only supports 15 cryptocurrencies.

Crypto.com Debit Card

This cryptocurrency exchange platform is based in Hong Kong, and they issue Bitcoin debit cards and other sorts of cryptocurrency-related products. The crypto debit card issued by crypto.com utilizes the CRO currency. When users add funds to this debit card, the funds are converted to CRO. To earn rewards, users must stake the converted CRO. Nevertheless, potential investors and users are advised to do copious research on CRO before investing in it, as its price is highly volatile.

Users who want to request the Crypto.com debit card will have to create an account on Crypto.com, carry out the KYC verification process, buy CRO tokens, and then lock up the minimum required amount of CRO tokens for no less than 6 months to order the Visa.

This debit card allows its holders to send their crypto anywhere Visa cards are accepted.

Advantages

This debit card can be funded using currency or crypto.

Charges no annual fees.

Supports more than 90 cryptos.

Users can get cashback rewards.

Disadvantages

Card users must possess CRO tokens.

To Investors

Similar to how credit card users use their cards to earn cashback and travel rewards, cryptocurrency investors can also earn rewards using debit cards. However, the challenge is trying to avoid fees associated with loading the debit card. Therefore, before you open a crypto debit card, you should do some calculations to ensure that the fees associated with it don’t exceed the anticipated rewards.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features