Exchanges serve as the vital core of the cryptocurrency market, facilitating the seamless movement and transformation of cryptocurrencies and tokens as acan prove to be a daunting task. Each exchange operates under its own unique set of regulations, fee structures, features, and investment opportunities. Hence, the significance of selecting an exchange that harmonizes with your specific investment objectives cannot be overstated.

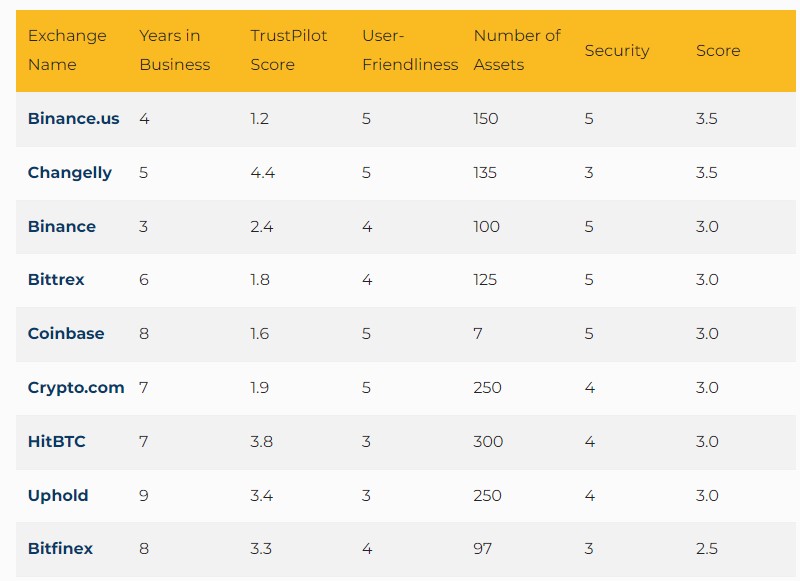

Exchanges are assessed and ranked according to various key criteria. These criteria encompass factors such as their longevity in the industry, TrustPilot ratings, the intuitiveness of their user interfaces, the diversity of assets they support, and the robustness of their security measures.

Binance US

At the top of the list is Binance US. Offering a comparable feature set to Binance but with a more streamlined selection of coins, this platform comes with a fee structure starting at 0.1%. Notably, it includes an automated buy feature. Established in 2019 and headquartered in San Francisco, this exchange is an offshoot of the renowned international exchange Binance. It empowers users to trade a wide spectrum of over 50 assets and provides cost-effective access to an array of trading pairs.

Changelly

Changelly, launched in 2015, primarily serves as a crypto swap service rather than a traditional exchange. It supports over 210 digital coins and tokens with a user-friendly platform. While it doesn’t offer recurring buys and may not be the ideal choice for long-term investors, it excels at crypto-to-crypto trading, charging a flat 0.25% fee. Users can easily purchase bitcoin and other digital assets via credit card. Changelly leverages trading APIs from top exchanges to provide competitive conversion rates.

Binance

Regular users are subject to a 0.1% maker/taker fee, with a 25% discount when utilizing BNB for trading. The platform enables recurring purchases and convenient withdrawals. Binance, one of the largest and fastest-growing exchanges, offers support for 100+ digital assets. It boasts an intuitive, user-friendly interface suitable for beginners, attracting a global user base of over 28 million.

Bittrex

Bittrex, established in 2014, is a Seattle-based exchange with competitive maker/taker fees ranging from 0.00% to 0.75%. Renowned for its focus on altcoins, Bittrex provides a diverse selection of digital assets, continuously adapting to investor demand. Particularly favored by ICO market participants, it swiftly lists new ICO tokens, earning a strong reputation in the industry.

Coinbase

Coinbase, a San Francisco-based exchange valued at approximately $70 billion, provides an easy-to-use platform suitable for beginners. While it offers convenient features like automatic recurring buys and straightforward withdrawals, its fees are relatively higher compared to other centralized exchanges, ranging from 1.49% for bank purchases to 3.99% for credit card transactions. Serving over 56 million users across 100+ countries, Coinbase supports various assets, including BTC, BCH, LTC, ETH, and more.

Crypto.com

Crypto.com, established in 2016 in Hong Kong, provides a comprehensive product suite, including a debit card. It supports cost-effective recurring buys, making it an ideal choice for cashless investors. The platform also introduces Crypto.com Chain, enabling users worldwide to receive payments in their preferred cryptocurrency.

HitBTC

HitBTC, launched in 2013, is renowned for its extensive altcoin selection but has relatively high trading fees and lacks recurring buy options. It stands out as one of the highest-volume BTC exchanges and caters to altcoin enthusiasts with a diverse range of over 300 digital assets.

Uphold

Uphold, a user-friendly US-based platform established in 2013, offers convenient fee-inclusive spread pricing for ease of buy calculations. Withdrawals are flexible, spanning bank transfers, crypto networks, P2P, and debit cards, with a $2.50 withdrawal fee. Supporting 30+ assets and catering to users in 180+ countries, Uphold also features zero fees on numerous crypto-to-crypto trades.

Bitfinex

Bitfinex, established in 2012 in Kazakhstan, offers a diverse range of digital currencies and tokens, appealing to both novice and experienced users. While it boasts high bitcoin trading volumes, it does levy a minimum 0.2% per trade fee, slightly higher than some more popular alternatives like Binance.

BitMart

BitMart, a Cayman Islands-based digital asset exchange founded in 2017, provides competitive fee structures starting at 0.25%. Professional traders can access market and taker fees as low as 0.04% and 0.06% by trading at least 150 BTC per month. With offices in the United States, China, and South Korea, BitMart offers some of the most competitive rates in the market.

Conclusion

In conclusion, when venturing into the world of cryptocurrency investments, selecting the right exchange is of paramount importance. Your choice should align with your specific investment objectives. Regardless of your preferences, prioritize exchanges that prioritize security, transparency, and accountability. This article should serve as a valuable resource in your quest to identify the exchange that best suits your needs, but it should be just one part of your comprehensive research into making an informed decision.

Hot Features

Hot Features