The USDC economy is transforming with a cutting-edge internet financial ecosystem. USDC, combined with blockchain networks and global developer expertise, leads a financial revolution for swifter, more accessible, and more secure transactions, democratizing financial accessibility for all.

Dollars for Anyone, Anywhere

Open blockchain networks redefine global finance, leveraging the internet to cut costs, boost transaction speed, and reimagine value exchange. In 2018, Circle introduced USDC, a payment stablecoin merging the strength, trust, and network effects of the US dollar with the capabilities of the open internet.

With the dollar’s dominance—over 90% in Latin America, 74% in the Asia Pacific, and 79% worldwide outside Europe—the potential is vast. Nearly $1 trillion in US bills, including a significant share of $100 bills, is held internationally. USDC, available in 190+ countries and secured in 3 million on-chain wallets, becomes the catalyst for widespread stablecoin activity, offering seamless access to digital dollars and pioneering a future of borderless digital financial accessibility.

An Open Platform for Money on the Internet

In recent years, USDC’s growth has been remarkable within the stablecoin network. Since 2018, it has facilitated $12 trillion in blockchain transactions, benefiting diverse countries. This adoption surge is inspiring developers to innovate new applications and strengthening the ecosystem of services around USDC for simplified acquisition, transfer, and storage.

Blockchain technology, mirroring the adoption curve of cloud computing, is gaining momentum after overcoming initial skepticism. Currently, 60% of corporate data is stored in the cloud, with 9 in 10 large enterprises adopting multi-cloud architectures. In the next phase, businesses are embracing Web3 on enterprise-grade blockchains. Circle’s role in constructing the Internet financial system aligns with, not competes against, the cloud, as blockchain networks provide secure data, transactions, and computational power to the public Internet.

Built for Blockchain Interoperability

USDC seamlessly resides on a diverse array of 15 blockchain networks, reflecting our commitment to accessibility. Our forward-looking strategy involves extending USDC availability to platforms where developers thrive, ensuring robust security measures are in place for its seamless traversal across the dynamic blockchain ecosystem.

Simultaneously, we’re dedicated to simplifying the intricate nature of blockchains, orchestrating a shift where complexities become inconspicuous. The cutting-edge Cross-Chain Transfer Protocol (CCTP), recently unveiled, plays a pivotal role in diminishing hurdles. By minimizing friction, enhancing safety and security, and curbing costs, CCTP facilitates the smooth movement of USDC from one blockchain to another, ushering in a new era of streamlined cross-chain transactions.

Open Money Around the World

In the last ten years, the Asia-Pacific region has ascended to a pivotal position on the global technology platform. This dynamic landscape has nurtured and propelled a wave of groundbreaking enterprises dedicated to delivering unparalleled convenience and connectivity to billions. Pioneering companies have emerged, fundamentally altering the fabric of both commerce and society.

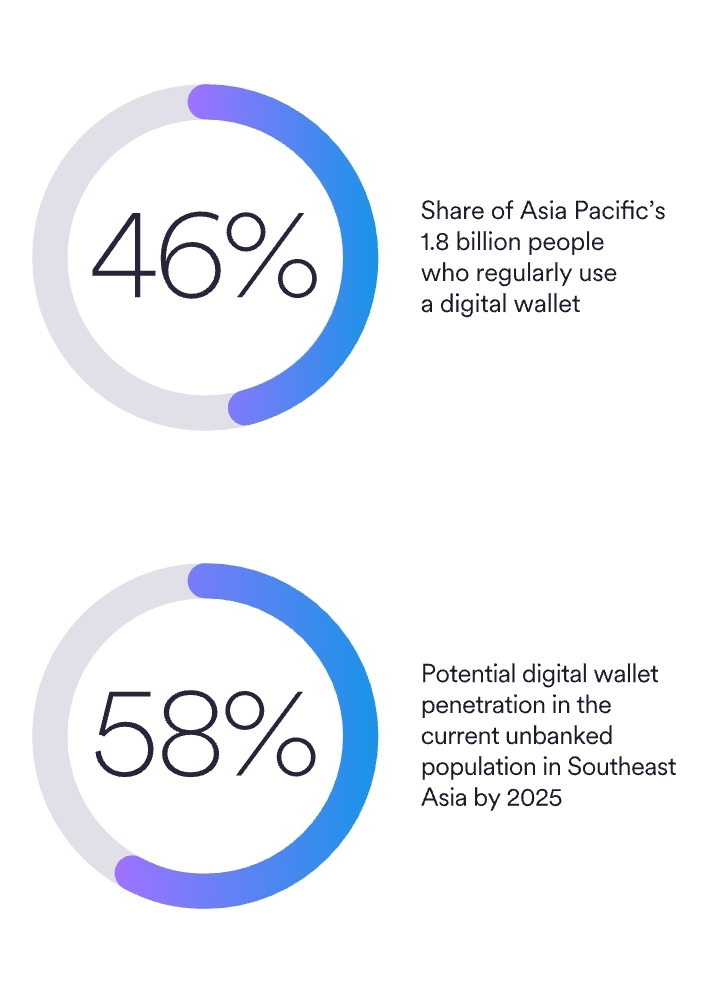

Asia-Pacific, with its youthful population, mobile-centric culture, and digital transaction readiness, is a powerhouse. Half of its 1.8 billion online population has adopted digital wallets, and the forecast anticipates a significant increase, projecting a 58% penetration among the unbanked in Southeast Asia by 2025. This signals the rapid adoption of digital financial tools, setting the stage for transformative shifts in transaction dynamics.

Regulators Takes the Lead

In the Asia Pacific, private sector innovation aligns with a strategic vision for a regulated digital economy. Farsighted governments cultivate a novel digital financial infrastructure, promoting swift, cost-effective, and transparent value movement for businesses and individuals.

A notable stride in this journey is witnessed in several Asian economies, including India, Singapore, Hong Kong, Malaysia, and Thailand, where the establishment of 24/7/365 real-time payment systems has achieved remarkable scale and volume.

Buoyed by the triumph of these real-time payment systems, regulators across the Asia-Pacific region are casting their gaze toward the next financial frontier. Swiftly navigating the landscape, they are actively laying the groundwork for regulatory frameworks tailored to the realm of payment stablecoins, anticipating and shaping the next evolution in financial landscapes.

How Stablecoins Can Expand Economic Opportunities

Asia stands at the forefront of embracing stablecoins, especially for cross-border applications that wield a profound influence on the region’s economies.

In cross-border payments, Asia, with a significant share of the world’s supply chain and ICT services, takes center stage. The projected $22.5 trillion in commercial trade for 2022–23, or nearly 65% of the region’s $35 trillion GDP, creates an ideal landscape for the efficiencies of stablecoins, offering a game-changing advantage for businesses in cross-border fund transfers.

Trade finance, a cornerstone for many small and medium-sized enterprises (SMEs), is pivotal for facilitating trade. As per estimates by the Asian Development Bank, the trade finance gap in Asia hovers around $510 billion. USDC and similar stablecoins emerge as potent tools to bridge this gap, simplifying access to dollars over the internet and empowering SMEs to secure crucial trade financing.

Remittances underscore the significance of stablecoins in Asia. In 2022, $130 billion flowed into the Asia-Pacific region, with an average cost of 5.7% for a $200 transfer. The challenge for recipients without bank access adds friction. USDC, on blockchains, revolutionizes this by enabling near-real-time global settlements at minimal costs, liberating users from the need for a traditional bank account. This positions stablecoins as catalysts for reshaping cross-border transactions in the region.

Crypto regulation is shown on a business photo using the text

Global Regulatory Clarity Is Coming

Internationally, major economies worldwide, including the US and UK, are emphasizing stablecoins and the broader digital asset market. The bipartisan Clarity for Payment Stablecoins Act of 2023 in the US, gaining traction with a July vote, targets accountability standards for stablecoin operators, especially in combating illicit finance tied to the US dollar.

In the UK, the Bank of England, Financial Conduct Authority, and His Majesty’s Treasury propose a comprehensive set of rules, creating a multifaceted regulatory framework. This aims to facilitate digital asset activities in one of the world’s leading financial centers. As nations globally collaborate on universal regulations for digital assets, the oversight of this growing sector is influenced by city-states and financial centers, highlighting the evolving dynamics in the regulatory landscape.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features