Looking to turn your crypto holdings into passive income? Crypto lending platforms offer a way to earn interest on your digital assets, similar to a traditional savings account. This guide explores the top crypto lending rates available (as of July 2024) to help you maximize your returns.

What is Crypto Lending?

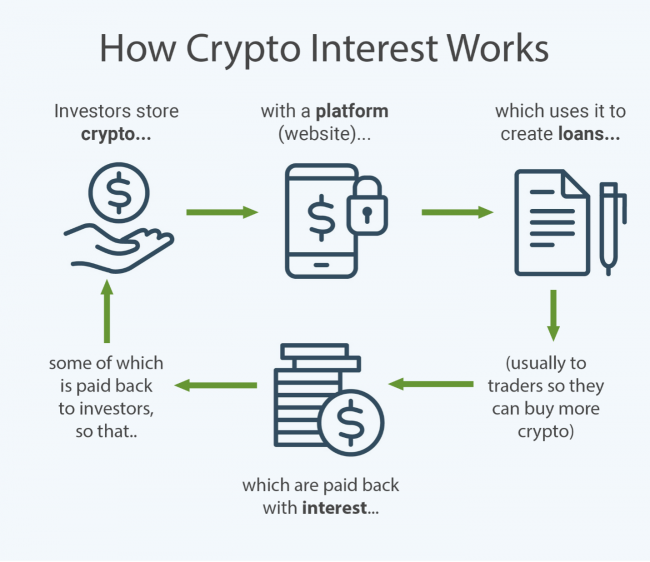

Crypto lending is like putting your crypto to work. Instead of just sitting in your digital wallet, you lend it out to others through a crypto lending platform. This platform acts as a matchmaker, connecting you (the lender) with borrowers who need crypto. They, in turn, pay interest on what they borrow, similar to how a traditional bank loan works. So, you essentially earn interest on your crypto holdings without having to sell them.

The Mechanism of Crypto Lending

The “mechanism” of crypto interest refers to the process by which you earn interest on your cryptocurrency holdings. It’s different from traditional bank interest because cryptocurrencies don’t have inherent interest-generating mechanisms. Here’s a breakdown of the mechanics behind crypto interest:

1. Crypto Lending Platforms: You deposit your crypto into a crypto lending platform, which acts as an intermediary. These platforms can be centralized (operated by a company) or decentralized (powered by blockchain technology).

2. Matching Borrowers and Lenders: The platform connects you (the lender) with borrowers who need crypto. Borrowers might need it for various reasons, like trading or margin investing.

3. Loan Collateral: Borrowers typically need to provide collateral, which is another cryptocurrency they deposit as security for the loan. This collateral incentivizes them to repay the loan and protects lenders in the event of default.

4. Interest Generation: The platform uses the deposited crypto from lenders to facilitate loans. The interest paid by borrowers on their crypto loans is the primary source of the interest you earn. The platform may also use other investment strategies, but borrower interest payments are a key factor.

5. Interest Distribution: The platform distributes a portion of the collected interest to lenders. This distribution can happen daily, weekly, or monthly, depending on the platform. Interest is usually paid in the same cryptocurrency you deposited.

Additional factors that can influence the mechanism are:

• Cryptocurrency Type: Different cryptocurrencies may have varying interest rates depending on demand and supply within the lending platform.

• Loan Term: Interest rates can also be affected by the loan term (how long the borrower keeps the crypto). Longer loan terms might offer slightly higher interest rates.

• Platform Fees: Crypto lending platforms may charge fees for their services. These fees can affect your overall return on investment.

Understanding the mechanism of crypto interest helps you make informed decisions about which platform to use and what crypto to lend for optimal returns.

Source: From bitcoinjournal.com

The Best CeFi Lending Rate:

Nexo

Nexo, a top crypto lending platform since 2017, manages over $12 billion in assets and serves more than 3 million users. Its user-friendly interface makes it ideal for beginners in crypto lending.

Nexo offers up to 18% APY on 29 supported cryptocurrencies, including BTC, ETH, and USDT. Stablecoin interest rates can exceed 10%, much higher than traditional savings accounts. The platform also allows for earning interest and borrowing in fiat currencies like USD, EUR, and GBP.

Investors favor Nexo for its compound daily payouts, flexible earnings, and $375 million in insurance on custodial assets. Using NEXO, the platform’s native token, provides additional benefits like better interest rates and more free withdrawals.

Crypto.com

Crypto.com, established in 2016, has grown into a leading cryptocurrency service with over 10 million users. It offers exchange, NFTs, payment, and lending services, backed by $750 million in insurance. Chosen by Visa to settle transactions, Crypto.com has demonstrated significant potential.

The Crypto Earn product provides an APY of over 10% on around 40 digital assets, including the native Crypto.com Coin (CRO). Staking more CRO can lead to higher interest rates and additional rewards.

CoinLoan

Launched in 2017, CoinLoan is a crypto lending platform that offers daily interest without locking funds. It supports over 20 assets, including stablecoins like USDC and USDT, cryptocurrencies like Bitcoin and Ethereum, and fiat currencies like GBP and EUR.

Interest rates are 7.2% for popular coins like Bitcoin and Ethereum and up to 12.3% for stablecoins. CoinLoan ensures fund safety with insured custody, vulnerability scans, 2FA, security alerts, and cold storage.

Best DeFi Lending

Aave

Aave is a leading DeFi platform that facilitates borrowing and lending without intermediaries or KYC/AML verification—just connect your Web3 wallet. It supports around 30 cryptocurrencies, including ETH, USDC, DAI, and USDT, and is powered by its native token, AAVE.

Compound

Compound, a major DeFi lending platform that ignited the DeFi boom in 2020, is known for its user-friendly interface. It supports over 20 cryptocurrencies for lending and borrowing. Users can also earn the native token, COMP, which grants governance rights similar to shareholder voting.

Investor Takeaway

Crypto lending platforms can help you maximize your digital assets. Both the CeFi and DeFi platforms have their pros and cons, so choose well-established platforms with strong reputations. Use our calculator to see your potential earnings.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features