Polymarket, a platform that allows users to bet on real-world events, has surged in popularity in recent years. By leveraging blockchain technology, this platform transforms predictions into financial instruments, enabling users to wager on a wide range of outcomes, from political elections to technological advancements.

While often categorized as a “prediction market,” Polymarket’s core functionality aligns more closely with a gambling platform. Users can stake cryptocurrency on their beliefs about future events, with the potential for substantial gains or losses. This has sparked debates about the ethical implications and regulatory oversight of such platforms.

Despite its controversial nature, Polymarket has captured the attention of mainstream media and influential figures like Elon Musk. Its ability to attract real-world interest and investment highlights the growing intersection of finance, technology, and speculation.

In the following guide, we will delve deeper into the mechanics of Polymarket, explore the distinction between gambling and investing, and uncover the genuine investment opportunities that may arise from its rapid expansion.

How Polymarket Works: A Simplified Explanation

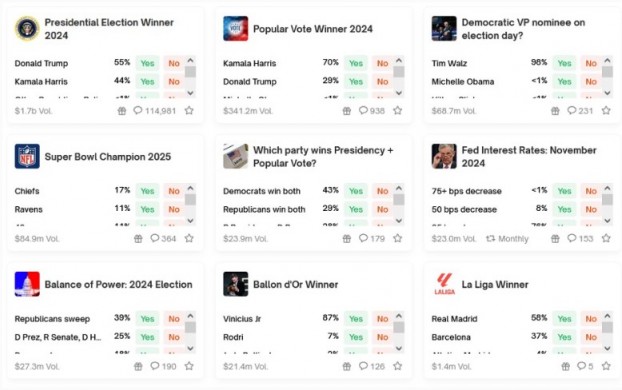

Polymarket is a platform that allows users to bet on real-world events. It’s like a stock market for predictions, where the price of a “share” reflects the market’s belief in a specific outcome.

Here’s how it works:

1. Create a Market: A market is created for a specific event, such as a political election or a product launch.

2. Buy Shares: Users can buy “Yes” shares if they believe the event will happen or “No” shares if they believe it won’t.

3. Price Determination: The price of a share fluctuates based on demand. If more people believe an event is likely, the price of the “Yes” share will increase.

4. Payout: At the end of the specified period, the market settles. If the event occurs, “Yes” shares pay out $1. If not, “No” shares pay out $1.

The Pitfalls of Polymarket

While Polymarket offers an intriguing way to participate in prediction markets, it’s important to be aware of its limitations. One significant issue is the potential for insider information to influence market outcomes. Individuals with privileged knowledge can manipulate the market by placing strategic bets, giving them an unfair advantage.

This can lead to skewed market prices and unfair outcomes for other participants. As a result, it’s crucial to approach Polymarket with caution and to be aware of the risks involved.

Gambling vs. Investing: The Polymarket Paradox

The Illusion of Prediction Markets: Polymarket, often touted as a cutting-edge prediction market, is essentially a sophisticated form of gambling. While it may seem like a platform for insightful speculation, its core mechanics rely on chance and uncertainty.

Unlike traditional investing, where value is created through the production of goods and services, Polymarket offers no tangible benefits to society. It’s a zero-sum game where one person’s gain is another’s loss.

The Blockchain Layer: A Double-Edged Sword

While Polymarket leverages blockchain technology to facilitate its operations, this doesn’t inherently transform it into a sound investment. The underlying blockchain infrastructure, such as Polygon and Ethereum, may have potential as long-term investments, but the specific use cases enabled by Polymarket itself are questionable.

The complex system of tokenization, NFT creation, and dispute resolution may be technically impressive, but it doesn’t mitigate the fundamental risk associated with gambling. In fact, it can create additional layers of complexity and uncertainty.

A Word of Caution

While it’s undeniable that blockchain technology has the potential to revolutionize various industries, it’s crucial to distinguish between promising innovations and speculative ventures. Polymarket, despite its flashy veneer, falls into the latter category.

Investors should exercise caution and focus on assets with intrinsic value and sustainable business models. Instead of betting on uncertain outcomes, consider investing in companies that contribute to real-world progress and economic growth.

Source: create.vista.com

The Informative Power of Prediction Markets

While Polymarket’s primary function is gambling, it can serve as a valuable tool for gathering and analyzing collective intelligence. By incentivizing participants to wager real money on their predictions, prediction markets can provide a more accurate and nuanced assessment of future events compared to traditional polling methods.

However, it’s important to remember that prediction markets are not infallible. Even the most likely outcomes can be subject to unexpected twists and turns. A 90% probability of a specific event does not guarantee its occurrence.

Therefore, while prediction markets can offer valuable insights, they should be used with a critical eye. It’s essential to consider multiple factors and avoid relying solely on market predictions when making important decisions.

Investing in the Infrastructure, Not the Gamble

While Polymarket itself may not be a direct investment opportunity, it provides a glimpse into the broader potential of blockchain technology. By investing in the underlying infrastructure, such as Polygon (POL) and Ethereum (ETH), you can indirectly participate in the growth of decentralized platforms and applications.

These blockchain networks power a wide range of innovative projects, including decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. By investing in these foundational technologies, you’re positioning yourself to benefit from the future of digital assets and the broader crypto economy.

Remember, while speculation and gambling can be tempting, long-term investment strategies focused on sustainable growth and technological innovation are more likely to yield positive returns.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features