Solana has experienced an extraordinary transformation over the past two years, witnessing a remarkable price surge of 2,143%. This analysis leverages newly developed metrics to dissect the intricate capital movements that have fueled this dramatic rise.

Benchmarking Against Industry Leaders

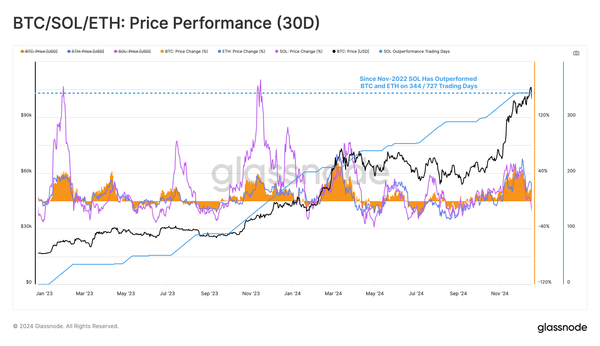

Over the last four years, Solana has been a focal point for both enthusiastic investment and market skepticism. The asset experienced exponential growth during the 2021 bull market but later encountered significant headwinds following the FTX collapse, which led to a substantial supply overhang.

Despite plunging to an alarming low of $9.64, Solana has staged an impressive comeback, appreciating by 2,143% over the past two years. This resurgence has positioned it ahead of Bitcoin and Ethereum in market performance on 344 out of 727 trading days post-FTX, emphasizing the robust demand and renewed investor confidence.

This rapid price acceleration has also attracted a fresh influx of capital into the Solana network. By analyzing the Realized Cap changes relative to Bitcoin and Ethereum, we can better evaluate and compare the distribution and flow of capital across these leading blockchain ecosystems.

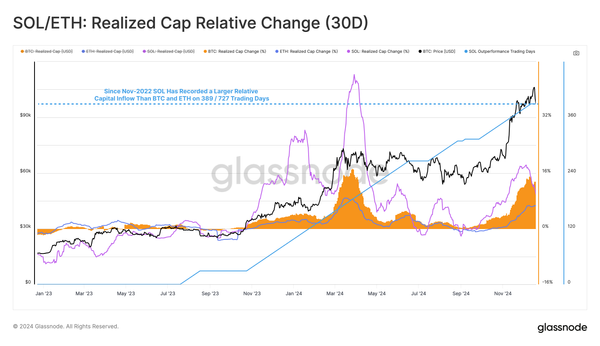

Capital Growth and Investor Demand in Solana

Since reaching its lowest point in December 2022, Solana has recorded a significantly higher percentage increase in capital compared to Bitcoin and Ethereum across 389 out of 727 trading days. This underscores its substantial liquidity expansion and market resilience.

To gauge demand-side momentum, we can examine the capital influx from new investors, measured by the Hot Realized Cap—a metric that tracks the capital held by accounts active within the past seven days.

A comparative analysis of fresh capital inflows between Solana and Ethereum reveals a historic shift: for the first time, new investor demand for Solana has surpassed that of Ethereum, emphasizing its growing market appeal. Notably, the sharp rise in Solana’s Hot Realized Cap leading up to 2024 signaled a pivotal turning point in the SOL/ETH ratio, with surging capital inflows acting as a catalyst for growth.

Analyzing Solana’s Capital Movements

Having established Solana’s dominance over other major assets, we now turn our focus to the scale and structure of its capital flows.

By examining the Net Realized Profit/Loss metric, we can track the first derivative of the Realized Cap—effectively mapping the daily fluctuations in on-chain capital movements. A positive reading indicates net capital creation (coins transacting at a profit), while a negative value reflects capital destruction (coins moving at a loss).

Since early September 2023, Solana has consistently maintained a net positive capital inflow, with only brief periods of minor outflows. This sustained liquidity injection has fueled its growth and price appreciation, reaching an extraordinary peak inflow of $776 million in new capital per day.

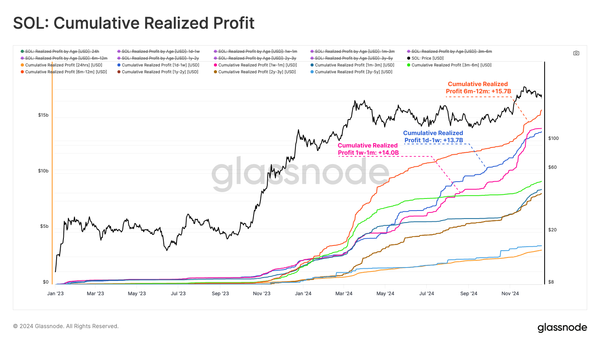

To refine our analysis, we assess the realized profit by coin age cohorts, determining which groups contribute most to sell-side pressure. Since January 2023, cumulative profit-taking volumes by age cohort are as follows:

24 hours: $3.1B

1 day – 1 week: $13.7B

1 week – 1 month: $14.0B

1 month – 3 months: $8.5B

6 months – 12 months: $15.7B

1 year – 2 years: $8.2B

2 years – 3 years: $8.2B

3 years – 5 years: $3.5B

Notably, the 1d–1w, 1w–1m, and 6m–12m cohorts exert the most sell-side pressure, collectively accounting for 51.6% of total realized profits. This even distribution across short- and mid-term holders reinforces Solana’s appeal as a viable investment for a diverse range of market participants.

Conclusion

The introduction of advanced breakdown metrics has provided an unprecedented view into investor behavior during volatile market phases, offering critical insights into Solana’s capital formation and depletion cycles.

Solana’s extraordinary rebound and price growth have not only cemented its position as a top-performing asset but have also attracted substantial capital across both institutional and retail investor segments, further solidifying its standing in the broader crypto landscape.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features