If you want to know which way gold is going to move the best thing to do is watch it every day on ADVFN and you should build up a feel for its real value. Gold should be a small part of your investment portfolio and nothing beats keeping tabs on your investments and the markets themselves.

Nothing holds the same value for long and the road to financial wellbeing is to buy what is cheap and sell what is expensive and to know which is which. On ADVFN that won’t cost you a penny, golden or otherwise.

Following the price of gold is essential as it is a badly understood thing. Gold lovers have a crazy view on it; even governments seem to have an irrational take. Gold is “the mad metal” and here are three things to bear in mind when you love or hate on gold.

1. The Gold Standard.

Sadly for the hard core gold bugs, there will never be a new gold standard. There will never, ever be a return to a gold standard, not even if the world implodes. If there was gold would have to be a million dollars an ounce.

There is just not enough gold in the world to be used as a value backed money medium. If gold was turned into money it would end up being money as detached from real value as paper. Communists would love gold as money because if we went back to gold coins as cash, we simply wouldn’t have much money around and little economy to go with it. Of course Romans had gold as money and guess what, they had mighty inflation too. Paper doesn’t create inflation and devaluation, government does, and it can do it with a gold backed currency or without it.

2. Gold is not a Stable Store of Value.

It is a myth to believe gold is a constant store of value. Like anything else the price of gold is created by supply and demand. When the Spanish pillaged South America and brought the gold and silver back to Europe, there was rampant inflation. More gold meant gold money was worth less and the price of things in gold went up.

Gold used to be worth a lot less than it is today. In ancient times silver was money and gold was five times more valued. Then the ratio went to 10, then 20 then 40 and so on. Now this ratio swings about daily. You don’t have to look hard to see gold is as vulnerable to swings in values as any other commodity. When it’s fixed by government, its value is as phony as any dollar bill.

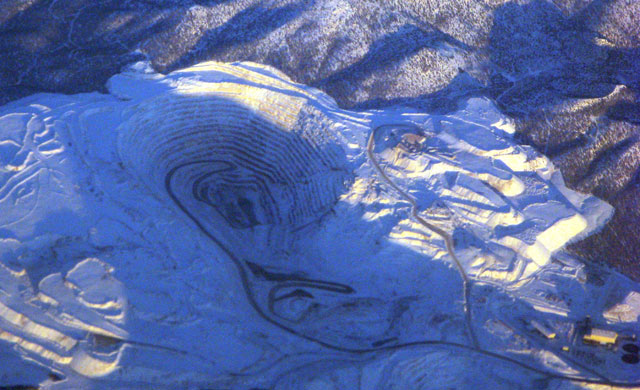

3. Gold is a Commodity.

To many people gold is something special. It’s more than just another metal that comes out of the ground. This may well be because since the dawn of time gold has been a status symbol and status is what breeds success or simply just breeds.

Whatever you feel about gold, it is just a metal. That isn’t necessarily a bad thing and it doesn’t mean it needs to be cheaper.

Gold supply has not kept up with demand so its price should rise. Where once gold was used on things that could be easily recycled. Now gold is used in things that don’t get recycled in a way that the gold is being recovered. So gold is being lost.

Hot Features

Hot Features