SunTrust Banks Inc. (NYSE:STI): The bank reported healthy financial numbers for the fourth quarter of the year. Its net income for the quarter stood at $350 million, up from $71 million it had reported for the corresponding quarter of the last year.

On per share basis, the income for the quarter was reported at 65 cents per share. SunTrust Banks also reported 12 percent higher revenue for the quarter at $2.3 billion. The stock is currently trading at $29.05, down 0.33 percent from its previous close. Its 52 weeks price range stands at $19.81 and $30.79. The stock is trading at the Price Earnings ratio of 8.09. SunTrust Bank commands market capitalization of $15.64 billion. The bank reported its full year net income at $1.9 billion, up from $495 million it had earned the previous year.

First Horizon National Corporation (NYSE:FHN): The stock is marginally down after the company announced 16 percent increase in its fourth quarter net income. The bank earned 17 cents per share in the quarter, up from 13 cents per share it had earned for the corresponding quarter of the previous year. It was expected to report the earnings at 17 cents per share. However, it lagged behind the consensus estimate for revenues as it fell 12 percent to $317 million. First Horizon stock is currently trading at $9.94, down 0.15 percent. It is trading below its 20 days moving average price of $9.98. The stock oscillated in the range of $9.94 and $10.02 in the current trading session. First Horizon reported its latest EPS at -$0.11. The company commands the market capitalization of $2.47 billion and its stock is trading at the beta of 1.72. The banking company suffered a loss of $27.8 million for the full year of 2012.

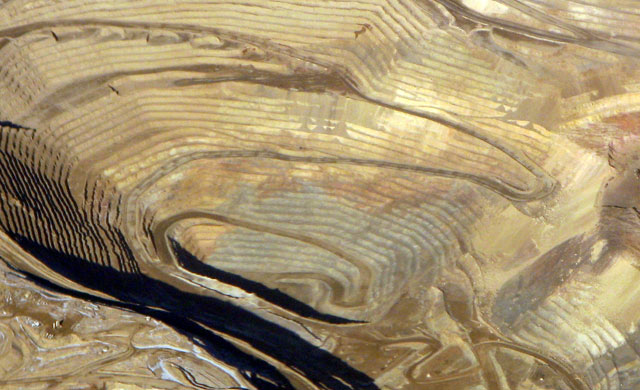

McMoRan Exploration Co. (NYSE:MMR): It is currently trading at $15.92, down 0.50 percent. It is trading in the range of $15.91 and $15.99 in the current trading session. McMoRan Exploration reported 31 percent decline in its fourth quarter revenue and posted net loss. The company’s net loss for the quarter stood at $1.2 million, while its revenue was reported at $84.2 million. McMoRan Exploration had earned a profit of $28.4 million and revenue of $121.9 in the corresponding quarter of the last year. The company was expected to report its revenue at $88.3 million. The stock is lower than its 20 days moving average price of $15.95 and 50 days moving average price of $15.97. In the past 52 weeks, the stock’s price range has been $7.25 and $16.13. The stock’s beta is 1.41 and its beta is 0.24. McMoRan commands market capitalization of $2.58 billion.

State Street Corporation (NYSE:STT): The company’s fourth quarter income stood at $521 million, up from $454 million income for the fourth quarter of the previous year. State Street also reported 7 percent increase in its revenue for the quarter to $2.46 billion. Its stock traded in the range of $53.25 and $54.96 in the current trading session and at this point is at $54.79, up 2.68 percent. State Street’s assets under management increased 2.7 percent to touch $2.089 trillion figure. The company stock’s highest price point of 52 weeks stands at $54.96 while its lowest price point is at $53.25. State Street stock is trading at Price Earnings ratio of 13.06 and its beta is 1.52. The company’s dividend yield stands at 1.80 percent. State Street announced cutting 2 percent of its workforce in order to curtail expenses. It will be laying off 630 employees.

Verizon Communications Inc. (NYSE:VZ): The stock is currently trading at $42.75, up 0.47 percent from its previous close. The company posted wider net loss for the fourth quarter as it incurred $1.48 per share in loss. Its overall loss stood at $4.23 billion, up from $2.02 billion loss it had reported for the fourth quarter of the year. However, its revenue for the quarter increased 9.5 percent and stood at $20 billion. Verizon Communications stock is trading below its 20 days moving average price of $42.83 but above its 50 days moving average price of $42.61. Its 52 weeks price range stands at $36.80 and $48.77. The stock is trading at the Price Earnings ratio of 39.86. Verizon Communications commands market capitalization of $122.01 billion.

Hot Features

Hot Features