Taiwan Semiconductor Manufacturing (NYSE: TSM, initial buy at $10.76) has plans to build a new advanced semiconductor plant in Mainland China, placing a substantial bet that it needs to be on the ground to capture as much market share of the fast-growing market as possible.

Chairman Dr. Morris Chang stated: “In view of the rapid growth of the Chinese semiconductor market, we have decided to establish a 12-inch wafer fab and a design service center in China to provide closer support to our customers there and to further expand our business opportunities.”

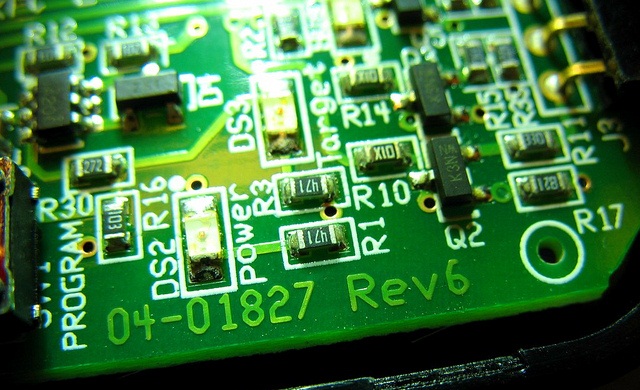

The world’s largest contract chip manufacturer has submitted an application to the authorities to build the wholly-owned fabrication (fab) plant in Nanjing, with a planned capacity of some 20,000 12-inch wafers per month. If approved, the plant is scheduled to begin volume production of the 16-nanometre process technology in 2H18. The design service centre will bolster the company’s design ecosystem with Chinese customers.

The Wall Street Journal reported that the entire project’s investment is valued at US$3 billion, but the actual capital investment will be less than that according to Taiwan Semiconductor.

The Taiwanese company already has a 8-inch fab in Shanghai, although this is less advanced than the proposed plant. Wafers are very thin slices of silicon critical to the chip manufacturing process and the larger diameter the wafers the better, although the technology to produce larger wafers with a good yield is more complex.

A number of semiconductor companies have made new investments in China this year, with many in the form of joint ventures. We expect the authorities to welcome more of these deals, as they want to bring the industry up the curve domestically. Indeed, the government has allocated funds to a number of initiatives for this purpose and is encouraging consolidation in the industry. Chinese companies are widely expected to target more companies in the sector for acquisition going forward.

Taiwan Semiconductor is far ahead of the Mainland Chinese contract manufacturers at this stage and is set to maintain that lead for a number of years yet given its far higher research and development budget and deep pool of expertise. By moving more advanced technology capacity to be “on the ground” in China, the company should quickly sign up a range of new customers.

The semiconductor industry endured a bit of a correction this year, but there are some hints things are picking up in recent numbers. Taiwan Semiconductor ADR’s have moved ahead of this over the past quarter and are now up around 15% over that time. With the company in the drivers’ seat to get the bulk of the A10 orders from Apple, we expect that momentum to continue into 2016.

For nearly 15 years, Fat Prophets remains UK’s premier equity research and funds management company. Register today to receive our special report Bargain Hunting, and a no obligation free trial to our popular email service

Hot Features

Hot Features