As time passes, uncertainty grows prior to Brexit referendum that is scheduled to take place the June 23 in the United Kingdom, and financial markets will be watching the latest surveys that will be released in the British media on the position of citizens about, prior this post-legislative referendum.

The British pound closed the week with slight, but volatile gains against the US dollar, driven not only by recent polls that favor the permanence of the UK in the European Union but also due to the recent and positive national economic data that favored to GBPUSD rallies.

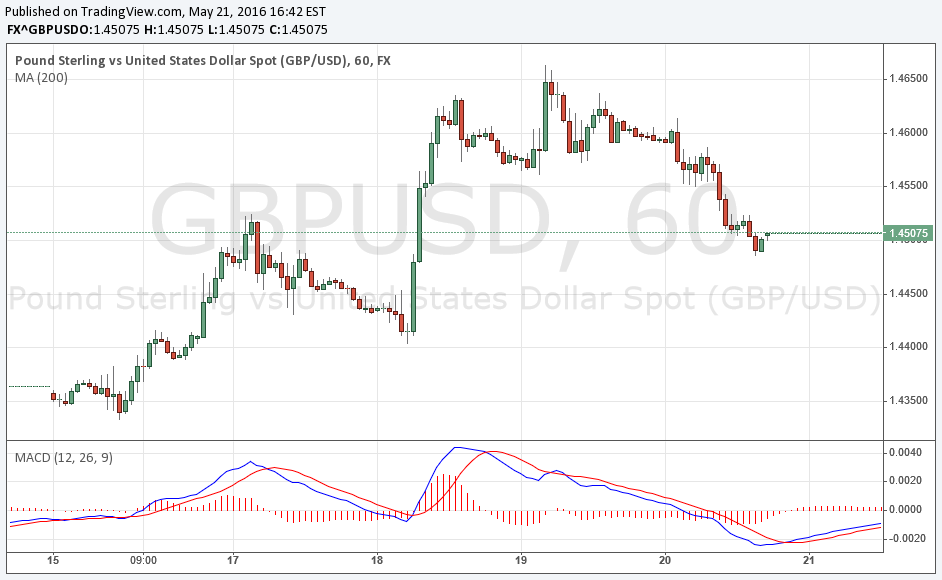

Technically speaking, the pair moves very close to the 200 SMA at H1 chart, correcting the upward cycle done since the May 16th session, and it would be highly probable that the Cable perform a rebound to resume the overall bullish bias.

On the other hand, traders can not ignore recent events leading to Brexit referendum, because although technical levels tell us much about the GBPUSD, fundamental analysis will be key to trading without much risk in a Forex pair that, without a doubt, will be very volatile during the month of June.

The MACD indicator remains in negative territory, but favors a certain way to make a rebound, because the oversold area is being achieved.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features