Consumer goods giant Unilever’s (LSE:ULVR) results, announced on Thursday, were mixed, with overall performance meeting expectations but not offering anything exciting for investors.

The company reported 2024 sales of €60.8 billion, which slightly exceeded analyst forecasts.

Organic sales growth was 4.3%, a little below the consensus of 4.3%, moderated by price increases. Volume growth remained steady.

The company’s operating margin improved by 15 basis points which was largely in line with expectations, while its operating profit of €11.2 billion was a modest increase over projections.

Earnings per share reached €2.98, up 2.1% year-over-year, reflecting stable profitability despite macroeconomic pressures.

The outlook remains cautious, with a slow start to 2025, and organic sales growth within the 3-5% mid-term range projected, but early quarters could see weaker momentum.

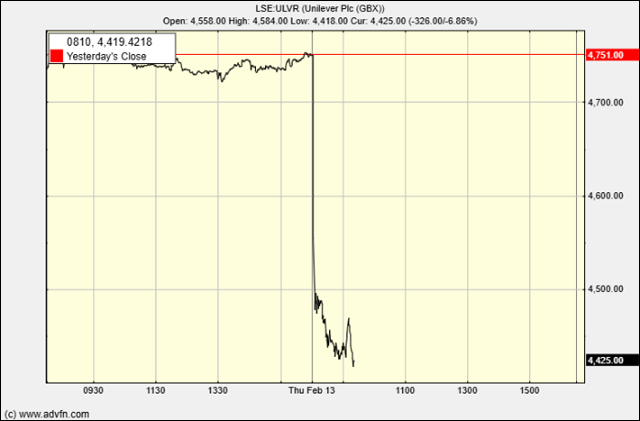

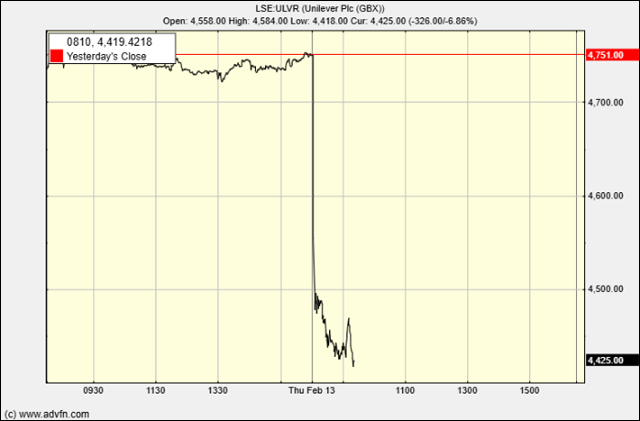

Investor sentiment since the results has been negative, with Unilever’s shares falling over 5% on concerns over the lack of a stronger growth catalyst and uncertainty about the impact of restructuring efforts.

The company is also preparing for the planned demerger of its ice cream business, which will list in Amsterdam, London, and New York under the leadership of Jean-Francois van Boxmeer, the former CEO of Heineken .

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features