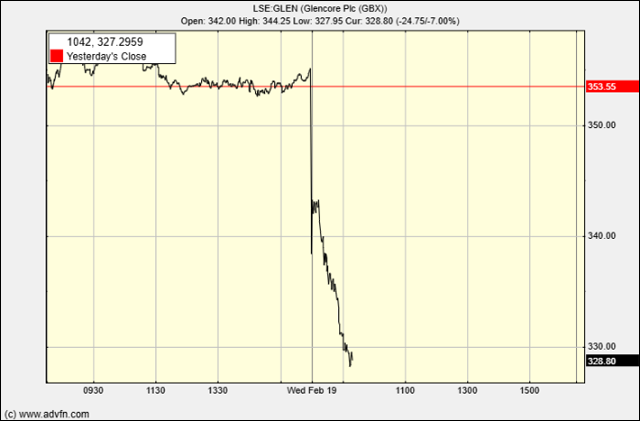

Shares in mining company Glencore (LSE:GLEN) dropped over 5% on Wednesday after it reported disappointing results. The company’s EBITDA was $14.36 billion, slightly below the $14.55 billion consensus estimate.

Glencore’s earnings declined 16% year on year, despite the inclusion of EVR from mid-2024, as lower coal prices weighed on performance. Marketing EBIT of $3.2 billion, down 8% year-over-year, performed slightly better than expected.

Glencore announced a $2.2 billion capital return program, consisting of a $1.2 billion base dividend and a $1 billion share buyback to be completed by August, in an effort to support shareholder returns.

Analysts at Morgan Stanley said in a note, “We believe that buy-side capital returns expectations were approximately at US$3bn.”

Glencore’s guidance for 2025 reflects weaker volumes, in-line capex, and lower cash costs. Based on mid-point volume guidance, cash costs, and spot prices, the company projects 2025 EBITDA of $15.5 billion, below consensus estimates of $16.85 billion.

In a note, analysts at Jefferies commented, “The bottom line is that we don’t expect clear, strong commodity tailwinds for Glencore until next year.”

Copper production guidance for 2025-27 is 5-8% lower than VA consensus, largely due to mine plan changes in South America, while zinc guidance is 2-14% lower.

Met-coal production guidance is up to 7% higher. Industrial capex remains at $6.6 billion annually, slightly above VA consensus of $6 billion, though the latter may not fully account for EVR.

On costs, copper unit costs were slightly higher than expected due to lower volumes and weaker cobalt/custom metallurgical credits, primarily from South America. Meanwhile, coal and zinc costs were lower, benefiting from portfolio optimization and cost-saving initiatives.

Glencore’s net debt stood at $11.2 billion, exceeding the company consensus of $8.7 billion, due to the assumption of $0.6 billion in EVR net debt and higher leases.

Hot Features

Hot Features