Top marks for those of you who figured out that the companies I’ve writing about, Company A and B, are Electrocomponents (LSE:ECM) and Premier Farnell (LSE:PFL).

Being a deep value investor it is Premier Farnell, Company B, I’m most interested in. It stands on a cyclically adjusted price earnings ratio, CAPE, of 8.5, measured by averaging earnings over ten years.

This is not only significantly below the average CAPE of the UK market at around 13, but is much lower than that for the other major player in its industry, Electrocomponents, on a CAPE of 16.4. (See Newsletter dated 18 March for details).

On the evidence of a low CAPE alone it is worth investigating as a potential share for a value portfolio.

I was even more encouraged when I looked at the margins and returns these companies generate (see Newsletter dated 29 March).

Their principal activity is distribution: basically having large warehouses and shipping stuff out to customers who mostly view and buy online.

I do not expect distributors to have mark-ups of 50-90%. And yet these two achieve that.

I do not expect distributors to produce annual returns on net tangible assets of between 11% and 24%, and yet these two achieve that.

I do not expect distributors to produce return on shareholders’ funds north of 72%, nor high owner earnings, and yet these Premier Farnell achieves that. Electrocomponents trails on return on shareholders’ funds at around 24% to 34% – but that is still a very respectable rate.

So, what is going on? How can you get customers to pay such high prices for components that you paid so little for?

The secret lies in (a) the specialised nature of the widgets distributed (some manufactured) and the loyal community they create, and;

(b) The limp competition between the companies in this industry. Perhaps both sets of managers understand the “prisoner’s dilemma” beloved of game theorists, and therefore send signals to each other avoid price competition. (If you want more on the idea of some industries settling down to high margins as a result of a realisation of the nature of the game they are immersed in, I can write some Newsletters (if you request them), or you could read my Financial Times Guide to Value Investing , chapter 9, p268-71).

Premier Farnell’s business

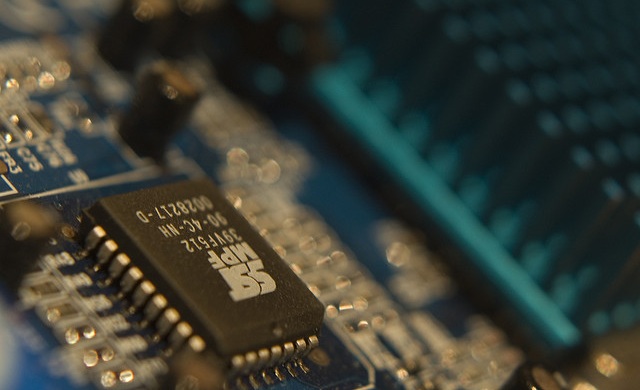

Premier Farnell sells a lot of stuff to engineers, especially electronic components and tools. These are not just any old engineers. A high proportion goes to those working on the cutting-edge of science and innovation. They are building prototypes, or building completely new gadgets, tools, whizz-bang things (do let me know if this language is too technical for you!).

They might be devising…………

To read the rest of this article, and more like it, subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features