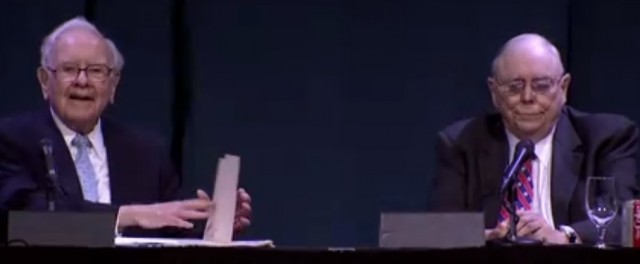

At the Berkshire Meeting, Buffett and Munger were asked a technical question about US Treasury bonds. The answer was that Buffett did not know, but then he launched into an attack on the notion of thinking bonds a good option for your money.

“The one thing we know is we think that long-term bonds are a terrible investment at current rates or anything close to current rates.”

The only reason BH invests in Treasuries is because they are waiting to place it elsewhere (predominately shares). While they are waiting they do not invest in Treasuries with long maturities (keeping the average down to about four months). At least they get around $10m per week in interest from this, “it’s not because we want to hold them. We’re waiting to do something else”.

Then he slammed long-term Treasuries: “they’re basically, at these rates – it’s almost ridiculous when you think about it. Because here the Federal Reserve Board is telling you we want 2% a year inflation. And the very long bond is not much more than 3%. And of course, if you’re an individual, then you pay tax on it. And let’s say it brings your after-tax return down to 2 1/2 percent. So the Federal Reserve is telling you that they’re going to do whatever’s in their power to make sure that you don’t get more than a half a percent a year of inflation-adjusted income.”

He much prefers investing in the risk-bearing capital of enterprises: “I think I would stick with productive businesses, or certain other productive assets – by far.”

Given those fundamentals he sees no point in fretting/analysing the bond market like so many in the financial markets: “But what the bond

……………To read the rest of this article, and more like it, subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features