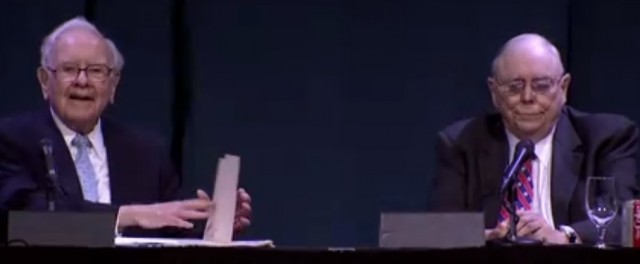

At last month’s Meeting in Omaha Buffett and Munger were asked their view on usefulness of what is conventionally taught about investing. The questioner at the Berkshire Meeting asked:

“Warren, you and Charlie have been critical of business schools in the past and what they teach. With respect to value investing, in “Superinvestors of Graham-and-Doddsville,” you featured the returns of many great investors with different backgrounds’ work in education, with the lesson being, “Following the philosophy is the key.” To be successful today, does it still just fall back to chapter eight of “The Intelligent Investor?” [Titled; The Investor and Market Fluctuations, it emphasises the difference between business valuations and stock-market valuations]. And what do you think of programs and designations such as CFA, CFP, etc, which purport high standards yet root it heavily into academia?”

Warren does not condemn what is taught:

“I went to three business schools, and at each I found a teacher or two. I went to one specifically to get a given teacher. But at each one of them I found a teacher or two that I really got a lot out of. So we’re not anti-business school here at all.”

However there are things that can be criticised:

“We do think that the priesthood, say, 30 years ago, for example, in terms of — or 40 years ago — in terms of efficient market theory and everything. They strayed pretty far, in our view, from the reality of investing. And I would rather have a person — if I could hire somebody among the top five graduates of number one, two or three of the business schools, and my choice was somebody that had — was bright — but had chapter eight of “The Intelligent Investor” absolutely — it just was natural to them — they had it in their bones, basically — I’d take the person from chapter eight.”

Investing is not as complex as business schools can make out:

“What we do is not a complicated business. It’s got to be a disciplined business, but it does not require a super IQ or anything of the sort. And there are a few fundamentals that are incredibly important, and you do have to understand accounting. And it helps to get out and talk to consumers and start thinking like a consumer in many ways in certain — and all of that. But it just doesn’t require advanced learning. And, I certainly, you know, I didn’t want to go to college, so I don’t know whether I would have done better or worse if I’d just quit after high school, you know, and read the books I read and all of that.”

Learning is available everywhere:

“I think that if you run into a few great teachers, and they really change the way you see the world to some degree, you know, you’re lucky. And you can find them in them in academia and you can find them in ordinary life.

And I’ve been extraordinarily lucky in having great teachers, including Charlie. I mean, Charlie’s been a wonderful teacher.

Anyplace you can find somebody that gives you insights into things you didn’t understand before, maybe makes you a better p……………To read the rest of this article, and more like it, subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features