Warren Buffett’s investment in the Buffalo Evening News is an example of his calculated risk-taking on the possibility of a business with a poor economic franchise being turned into one with a brilliant franchise and superb returns on capital employed. At the very least, we learn from this case the need for long-term thinking based on the soft science of strategic positioning, and about the need for resilience and mental fortitude in face of many years of losses.

Summary of the deal

| Deal | Buffalo Evening News | ||||||||||

| Time | 1977 – present | ||||||||||

| Price paid | $35m | ||||||||||

| Quantity | 100% of the share capital | ||||||||||

| Sale price | Part of Berkshire Hathaway today | ||||||||||

| Profit | At least 15-fold | ||||||||||

Berkshire Hathaway in 1977

|

To understand the beauty of the Buffalo Evening News investment you need to imagine a world before the internet. In this world, if a town had only one newspaper then that business could be an excellent economic franchise. This local monopoly was in a position to both charge extra on the cover price and, more significantly, raise the rates for an advertisements.

The problem is that everyone in the investment community knew that one-paper towns are rich-seamed goldmines, and therefore when a paper came up for sale it fetched a high price. In many cases the price was so high that buyers ended with the “winner’s curse” – they won the auction but regretted it ever afterwards.

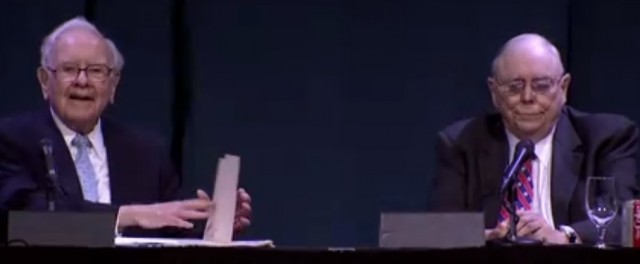

So Buffett and Munger looked and looked, examined and rejected potential newspaper acquisitions. A small number of shares were bought in four newspaper companies, but the stakes couldn’t be built up without paying too much.

Then the Buffalo Evening News came on the market. It was not priced exceptionally high, but there were good reasons for that:

- First, it was one of two newspaper companies operating in Buffalo. They had hacked at each other for years, lowering each other’s profits in their desperate competitive attacks.

- Second, the managers had regularly caved-in to union demands to such an extent that it was difficult to determine for whose benefit the company was being run – certainly the shareholders didn’t seem to get much.

- Third, it did not publish a Sunday edition, the day most attractive to advertisers because readers tended to loiter more.

- Finally, it was in Buffalo, a town down on its luck; a rustbelt town with a shrinking population.

Already The Washington Post and the Chicago Tribune had declined their invitations to make offers. But Buffett and Munger could see a path through the immediate difficulties, and they had a vision what it might become.

But, as it turned out, getting to those sunny uplands took five years of pain and losses. There were times when Buffett was all for throwing in the towel; he prepared himself to take the punch of a $35m loss. But at the darkest moments Charlie Munger, with the help of others, hauled Buffett back on board, for them to make yet one more push.

It was very tough, but by sticking it out they created a business that in the decade of the 1980s gave back to Berkshire over three times what was paid for it. It was even better in the 1990s with nearly $300m sent to Berkshire to invest elsewhere – not bad for a $35m investment.

Newspaper economic franchises in the 1970s and 1980s

The ideal business to own is an “unregulated toll-bridge” because, according to Buffett, once the capital cost has been paid you can raise prices to o

……………To read the rest of this article, and more like it, subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features