First: A tip to simplify portfolio construction to manageable proportions – favour low-change industries

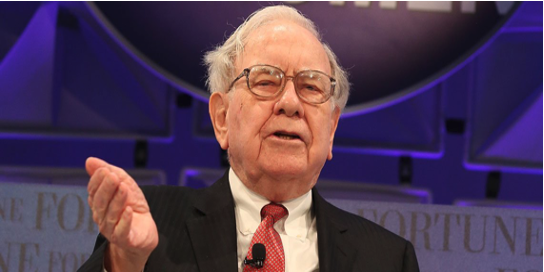

Buffett and Munger made life simpler for themselves by investing in businesses and industries unlikely to experience major change. “The reason for that is simple: we are searching for operations that we believe are virtually certain to possess enormous competitive strength ten or twenty years from now. A fast-changing industry environment may offer the chance for huge wins, but it precludes the certainty we seek.” (Warren Buffett’s Letter to Berkshire Hathaway shareholders 1996)

This advice does not mean searching out areas where there will be no change at all. That wouldn’t work because all businesses are subject to some change. But it does mean looking for areas where the fundamental economics (pricing power relationships) are unlikely to alter.

Buffett highlights the example of See’s Candy where change has clearly come. The range of candy has changed, as has the machinery used in production and some of the methods of distribution.

But people today buy See’s candy for the same reasons they did in 1972 when the company was bought by Berkshire and these reasons are not likely to change over the next 50 years (in California there is long established devotion to See’s Candy – no Californian would want to give their girlfriend, wife or mother a lower quality candy).

Another example: Coca-Cola. It is continually looking to improve the way it carries out its operations to gain efficiencies. New technology will help, new advertising methods on the internet will help. But………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features