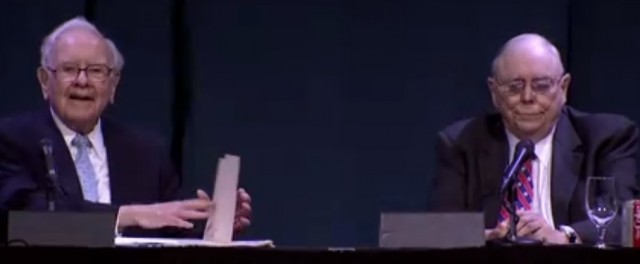

The billionaire investor Charlie Munger has been selecting shares for over 70 years. Generously, he is willing to share what he has learned in that time. I’ll focus today on some of his rules for running a portfolio. They come from a recent interview.

“You don’t need to own a lot of things in order to get rich.”

Many portfolio managers seem to think it is necessary to split a portfolio between 40 or 50 stocks – sometimes they go to over 100.

The truth is that the benefits of additional diversification beyond 15 stocks are very small in terms of lowering portfolio volatility risk.

But there are enormous downsides to holding dozens of shares:

(1) insufficient familiarity with any of them – how can you thoroughly analyse so many?

(2) moving too far down the marginal attractiveness curve – if you list companies in order of attractiveness why put money into company number 40 on the list when you could have more of company one or two?

(3) the more you move towards matching the index the more you will perform like the index – why aim at being mediocre?

“A great company keeps working after you are not; a mediocre company won’t do that”

There are some companies that are so well positioned in their market place, with durable barriers to entry and pricing power, that they are likely to be making excellent returns on capital decades from now. We can all think of companies in that position, particularly those with a high share of mind, e.g. Coca-Cola, American Express or Diagio

So why invest in companies that do not have strong stable strategic positions with first class managers and financial stability, just because it’s the “latest thing”? (Of course, you should not buy strong franchise companies when the shares are over-priced).

“Don’t bail away in a sinking boat if you can swim to one that is seaworthy.”

From time to time you’ll find yourself invested in a company that loses its way. This could be because the industry economics change and it loses its pricing power. Or it might be that the managers turn out to less than first class in terms of competence or integrity with regard to shareholders.

Then you are faced with two options (1) as an interested shareholder you could work with the managers to correct matters, or (2) (the one recommended by Charlie Munger) sell your shares, even at a loss, and buy shares in a better company.

Charlie and Warren Buffett have worked together on many bail out operations and on the whole found them exhausting and less profitable than moving money out.

“There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.”

Don’t get greedy and impatient but rather be prepared to stick to sound investing principles and get rich slowly. Why risk losing all your current wealth just to try to rapidly obtain double – risking what you need in the hope of obtaining what you don’t need?

“Warren [Buffett] and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.”

The economics of an industry can change. Where once there was over-capacity, declining volume and low margins, as in US railways, shifts in market structure and the position of substitutes (road freight costs) and complementary services (e.g. shipping containers, ports) can improve the pricing power especially if the industry shifts to a oligopoly.

So, keep an open mind. Keep challenging your well-loved ideas. One way Charlie, Warren and I do that is by spending a good proportion of each day reading intelligent newspapers.

Prof Glen Arnold now offers a Managed Portfolio Service at Henry Spain Investment Services under which clients’ portfolios contain the same shares as his (write to Jackie.Tran@henryspain.co.uk)

Hot Features

Hot Features