Oil prices recently fell sharply as weak economic indicators from China and Europe has reduced the overall demand, a situation that has even added to the growing doubts of investors over the debt crisis in Europe.

Reports reveal that Brent November crude futures had declined in prices by $3.27 to $108.30 a barrel, while U.S November crude had shed $3.02 to stand at $88.87 a barrel.

China which has been showing some signs of economic recession as consumer spending has reduced considerably, also showed official purchasing managers’ index for the service sector fall to 53.7 in September from the 56.3 that it earlier stood in August, even as growth in the country’s manufacturing sector stabilized at a slower pace.

In Europe, much more than the prolonged sovereign debt crisis that has hit the zone for long. The dwindling new orders and faster layoffs have marked an even worsening decline for euro zone companies last month.

Much of the crisis in Europe has affected the drop in Oil consumption and demand as motorists cut back their spending on fuel during the usually busy driving months of the European summer.

The bearish run in the market has been from the overall caution that has been adopted by many investors after euro doom was worsened by major concerns over whether Spain will ask for bailout or not, and also the uncharacteristic uncertainty about the economy of China.

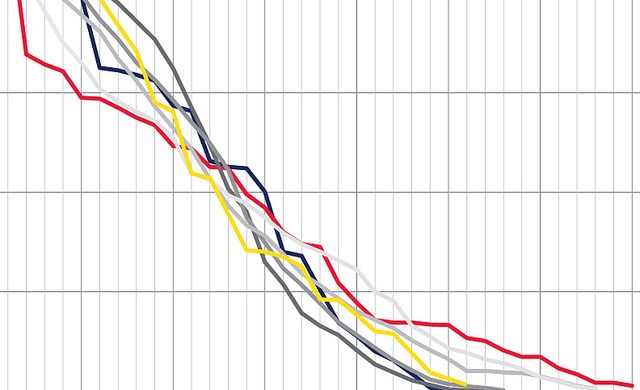

To compound investors bearish attitude is the fact that Brent crude also ended Tuesday below two significant technical support levels on charts of price movements, the 50 day moving average of $112.06 and the 200 day moving average at $112.09 which makes rebounds significantly more difficult to achieve.

Feeders from the United States seem not to be helping much of the problems, even as less than expected favorable job reports released by the employment data have not had any bearing on the recent sentiment of oil.

Oil prices still stand more than $20 a barrel higher than they were in some few months back, as concerns about the imminent Iran/Israeli/America conflict looms larger.

Most of investors’ concerns have stemmed from the rising tension in Iran, as both internal and external relations seem to be breaking down. Investors are also getting more convinced that the growing dispute over the country’s nuclear program may drag longer than expected, thereby having a pull over oil prices.

While much of the worries of investors are grounded, the prices of oil may not however decline further, as the tension between Iran and Israel may keep pressure on the market in the next four months, a situation that will favor a bullish run.

Hot Features

Hot Features