The case of London-based global natural gas producer, BG Group plc (LSE:BG.), is a classic example of how one firm tries to break the bad news ever so gently, almost concealing if only there was a way, but is ultimately faced with the reality that the truth will have to come out sooner or later.

Looking at the company’s financial results for the third quarter and the 9-month period fiscal performance, the task of figuring out the reason why the FTSE 100 constituent had lost about a fifth of its market value in early morning trading today is almost as exciting as how the group explores the globe for new hydrocarbon deposits.

There’s The Rub

Frankly, it took me quite a while. Smacked right at the centre of the company’s announcement is the rub that BG lost about US$519 million of operating profit for the nine months ending 30th September 2012 after including losses in disposal of assets reaching US$1.382B.

Pre-tax profit since January to September was down US$444 million to US$5.168 billion for a total count of US$2.869 billion in after tax profit, both continuing and discontinued operations, 4% below last year’s.

But what may have aggravated the results was BG’s warning that next year’s production will be at about the same volume as the current year’s 12-month growth, which it now pegged at only 3%.

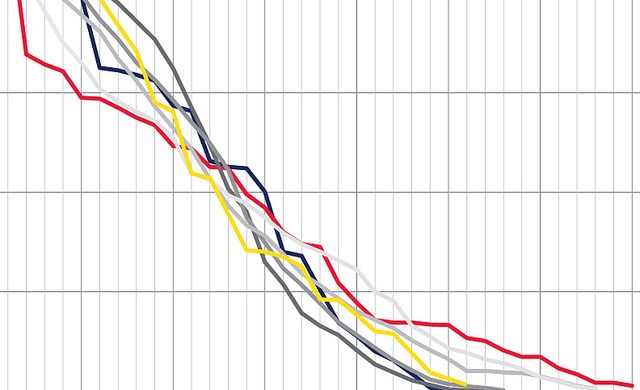

A few moments after BG released this statement, the company’s share price plunged 20%, shedding 267.50 pence, or about £9 billion from its market value, by 11:00 AM GMT.

Two hours after, the share price gained 3 percentage points but was still down 17% to £11.03 a share at 1:30 PM GMT, for a total trading volume of 63 million shares.

Flat Production

Sir Frank Chapman, BG’s Chief Executive, blamed falling natural gas prices in the United States that forced the firm to “scale back” operations in the said country, the shutdown of BG’s non-operated Elgin/Franklin field in the UK North Sea, lower production in Egypt, deferral of start up production of Jasmine field – also in the North Sea, and delays in subsea connections in Brazil will all contribute to the flat production volume for the 2013 fiscal year.

BG had earlier reduced its production rate from 750,000 barrels of oil equivalent per day to 720,000 boepd. In 2011, a total of 234.1 million barrels of oil equivalents were extracted by the group for the whole year. No full year estimates were given by the firm by the end of 2012. I guess we’ll just have to wait for next year – by then I hope it is not going to be as challenging as what I had to deal with today.

Hot Features

Hot Features