Energy giant loses $610m in Q1

Exxon Mobil (XOM) has reported its first quarterly loss in 32 years, as the plunge in global oil prices continues to haemorhage the energy giant.

The company lost $610m (£488m, €555m) in the first quarter of 2020, largely thanks to the $2.9bn in writedowns tied to falling oil prices.

In the first quarter of 2019, with revenues of $64.64bn, Exxon reported earnings of $2.35bn, or 55 cents per share. A year later the firm posted a GAAP loss of 14 cents per share and a non-GAAP profit of 53 cents per share.

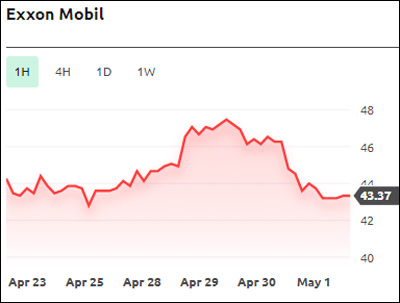

Chastened by the fact that Q1 figures only reflect the beginning of the economic devastation triggered by the Covid-19 pandemic, Exxon Mobil’s share price fell 5.91 per cent by early-afternoon Friday trading (EDT), to stand at $43.66. The company’s stock has dropped 37 per cent on the year to date.

CEO Darren Woods recognised the impact of the coronavirus outbreak on near-term demand, but stated: “While we manage through these challenging times, we are not losing sight of the long-term fundamentals that drive our business. Economic activity will return, and populations and standards of living will increase, which will in turn drive demand for our products and a recovery of the industry.”

The latest results come hot on the heels of Shell’s historic decision to cut its dividend for the first time since the Second World War. Exxon did not follow its rivals lead but did keep its dividend unchanged for the first time in 13 years.

Hot Features

Hot Features