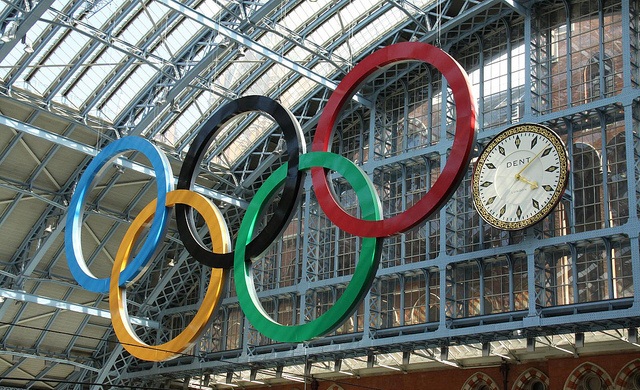

Security services giant G4S (LSE:GFS) suffered through the summer, not winning any medals for its less-than-stellar Olympic performance. Over the last 30 days, however, the company appears to be getting back into shape. It issued what was at least a bronze medal half-yearly report on 28 August and should win a gold for their announcement this morning, 28 September. Halfway between the August report and their announcement this morning, the G4S share price rose about its 90-day average since 13 July. The share price was at 266.00 at the noon hour, a modest gain for the day on what appears to be a steady climb back to its 5 year high of 292.00 which it reached on St. Patrick’s Day this year.

The Bronze Medal Report

G4S reported a 5.8% increase in turnover and a 5.1% increase in organic growth for the first half excluding any income from either their Olympics or Paralympics contracts, a solid indication that the company was still well-focused on its core business. Of course, some people would say that that was fairly obvious given their Olympic performance.

Cash flow for the period grew from £143 million year-on-year to £197 million. Net debt at the end of the period was up only slightly from £1,616 million to £1,683 million. G4S reported its greatest percentage of organic growth in its emerging markets sector, at 10%, with consistent growth in all geographic sectors.

Reducing headcount by 1,100 during the first half restructuring is projected to generate an annualized cost savings of £30 million. Additional cost savings are expected to be realized by increased efficiency in procurement and process control.

The Gold Medal Announcement

The company released an analysis of its London 2012 performance this morning, and the board seems to have applied practical wisdom in both its analysis and its corrective actions. By not responding with a knee-jerk reaction — as most companies do — by terminating the CEO as a scapegoat, they recognized that “Whilst the CEO has ultimate responsibility for the Company’s performance, the review did not identify significant shortcomings in his performance or serious failings attributable to him in connection wit the Olympic contract.”

On the other hand, the Board “has accepted the resignations of David Taylor-Smith, Chief Operating Officers and Regional CEO – UK and Africa, and of Ian Horseman Sewell, Managing Director, G4S Global Events. Getting to the real source of the inept and embarrassing handling of the security of the Games by dispatching the heads of the hands-on staff deserves a standing ovation as well as a gold medal. It indicates that the Review was conducted properly and that its findings were valid.

Insert pet peeve here –> The CEO must trust his staff. Failure is usually at the CEO staff level or lower. Terminating a CEO for the failure of some of his staff is absurd. It’s like doing a heart transplant to cure colon cancer.

Resume article here –> Richard Morris, the current Group Managing Director of Care & Justice in the UK will essentially replace Taylor-Smith. Kim Morris has been promoted from a portfolio manager of commercial and government business to handle all government business in the UK. The newly created position of Group COO will be filled from without.

Real Change Equals Real Results

The half year report indicates that the company was able to handle its considerably large portfolio of accounts well in the face of trying to handle one major, highly publicized fiasco. The announcement this morning indicates that the Review was much more objective in nature than most and that the corrective actions were applied as a result of correct analysis. The objective of corrective action is to prevent a problem from recurring. In this writer’s opinion G4S has responded appropriately and should, therefore, see significant positive and sustainable results.

Hot Features

Hot Features