African Barrick Gold (LSE:ABG) share price was up over 10 pence to 460.7 in early trading on the LSE this morning. Although the price eased back to 457.8 during the noon hour, it is still above yesterday’s close of 455.00. The share price has been on the rise since 23 July when it reached a 3-month low of 317.

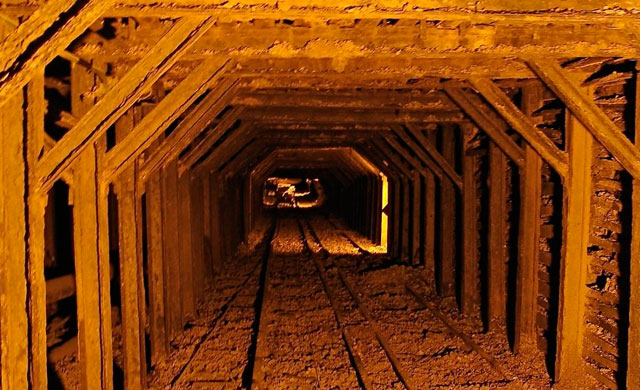

The upward surge this morning was likely fueled by the company’s announcement that it has raised its reserves estimate at its Bulyanhulu complex in Tanzania. It’s original estimate of 1.2 million ounces over the life of the mine has been increased by 0.9 million ounces in the undeveloped Reef 2 to a total of 2.1 million ounces for the entire complex.

The company underscored the importance of the additional reserves by announcing that the board has already approved the cap ex costs for the expansion and that Barrick has already begun placing orders for materials and equipment with the longest-lead times, indicating the company’s commitment to moving assertively to get to the gold in a timely manner, especially when the addition of Reef 2 will be an incremental production increase of 90,000 ounces per year, bring total annual production to 400,000 ounces per year.

In the report ABG CEO Greg Hawkins said: “One of our key aims for this year is to progress the expansion of Bulyanhulu in order to accelerate the realisation of the value provided by the scale of the reserve base. We have now successfully expanded the scope of the Upper East Project whilst maintaining our planned timeline for first production.” The company is targeting production start up in 2014.

In addition to the increased production the Reef 2 would add, the cost of production there is estimated at $608 per ounce. That will dilute the current overall cost at Bulyanhulu which currently stands at $700 per ounce. Part of the reduced cost is due to the proximity of Reef 2 to the current operating mine. They are only 1.5 km apart. The estimated internal rate of return, based on the current price of gold at $1,700 per ounce is 34.3%, or $583.10. That calculates to $23,3 million per year once peak capacity is reached. This balance out very nicely against the estimated capital expenditures of $4.3 million in 2013 and $6.5 million in 2014.

The addition of Reef 2 should enhance ABG’s position as the largest gold mining operation in Tanzania and might possibly increase its rank among the top five gold producers in Africa.

Hot Features

Hot Features