ARM Holdings (LSE:ARM) is all over the financial news this morning as there seems to be a downgrade consensus by analysts. ARM’s share price was down 33.50 to 839.50 at midday.

Morgan Stanley cut ARM to equal weight from overweight, but raised its target from 725.00 pence to 911.00 pence. Investec dropped it from hold to buy and raised its target from 800.00 to 900.00. ARM is coming off its five-year high of 873.00 reached yesterday, 14 January 2013. Actually, it is probably more accurate to say that ARM has been setting a new record five-year high on most days since 24 October 2012 when the share price hit 675.50.

The analysts’ perspective makes sense when you consider that the share price has increased a whopping 70% in the last six months as the company has continued to seize new opportunities in the highly competitive and expanding consumer electronics market. As we all know everything has a ceiling. Or at least that is what history tells us.

Speaking of consumer electronics, ARM made its usual strong appearance at the Consumer Electronics Show in Las Vegas, where Forbes described the company as “the real powerhouse” in the mobile electronics revolution. While the analysts wonder how much more ARM can grow, it may be that a gentle reminder of what ARM really does might need to be kept in mind, because the actual business that the company does is so far afield from most electronics companies.

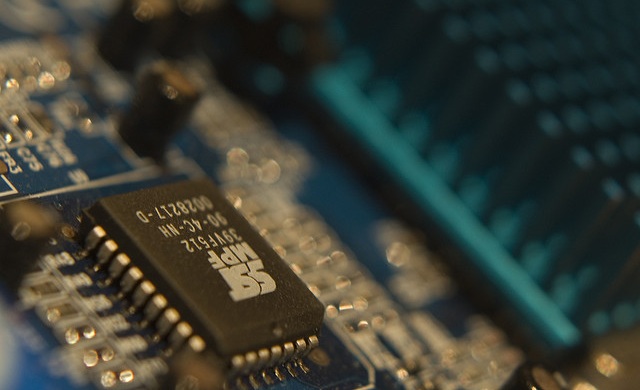

ARM does not manufacture anything. It custom designs innovative circuits, licenses them to chip makers, and leaves the worry of the competition in the marketplace to the chip makers. ARM has not found a niche. It has created one. Although its designs have been primarily for smartphones, ARM has taken big strides into the computer operating system sector in the last couple of years.

The company is now entering into the television market. While that may be of little interest to many observers based on the accepted fact that the TV market is somewhat saturated, once again, ARM is ahead of the pack, developing circuitry designs for “Smart TV.” ARM’s licensees aren’t even thinking about TV as we know it. They are advancing into the world of single user interface sets that will have pre-teens all over the world saying, “Here, Grandpa. Let me show you how to do that.” So once again, ARM positions itself to be the most compelling source for the most basic need of an advanced product that multiple manufacturers produce.

ARM CEO Warren East also let it be known that the company has the server processor market in its cross-hairs. East said that IT equipment now uses about 10% of the world’s electrical power and that amount is expected to increase by a factor of more than 100 in the next few years. Simply put, he said that “The digital world is not going to become a reality unless servers and network infrastructure is designed in a different way.” The entire IT and electronics world knows, that to succeed in making their dreams come true, they are going to need more power. So, as East predicts, “They are going to switch to ARM because it is all about the power.”

ARM appears to be positioned right where it wants to be in targeting its four major target markets, which are smartphones, tablets, and laptops; micro-controllers; servers; and network infrastructure. The CEO expects royalty growth in the mid-teens. Simply based on the unique deliverables that ARM brings to market, it appears that ARM may defy the normal constructs, just as it has been doing, for some time to come. ARM doesn’t deliver innovative product. It delivers innovative ideas and solutions. And that it was a lot of electronics companies need.

Hot Features

Hot Features