Lately the U.S. and UK markets have been getting excitinger and excitinger. I know that’s bad grammar, but I just can’t help it. It’s exciting! We’ve been watching the FTSE 100 as we promised. (Obviously we would do that anyway.) But we can’t ignore the NASDAQ and the Russell 2000, both of which are reaching new heights today.

First, the Footsie

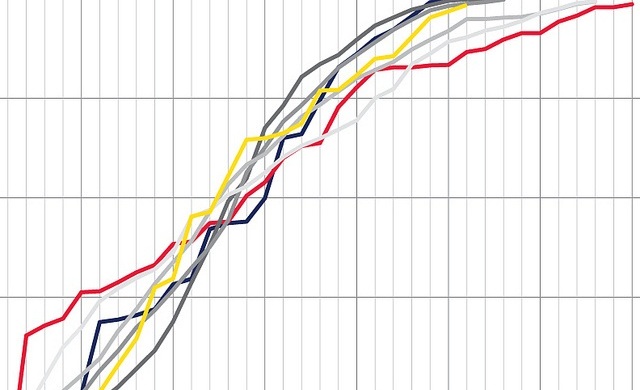

After hitting a record intraday high of 6,954.63 on 24 February, the FTSE drew back on Friday, but traders showed their enthusiasm again today, pushing the index to yet another new high of 6,974.26, where one could almost breathe the thinner air of the once unimaginable height of 7,000. The FTSE reached its new high just after 10:00 am UTC, before reports of further slowing of the Chinese economy began to weigh things down in the mining sector.

Reports out of Africa caused significant concern for Tullow Oil (LSE:TLW), so much so that Tullow shares got the biggest black eye of the day, dropping 7.8% to 357.30 on trading that was double the company’s 90-day average. That per share loss translated to a £200 million decline in the company’s market value, casting some doubt on Tullow’s ability to remain in the FTSE 100 very much longer. Tullow’s TEN project is situated in contested territorial waters off the coasts of Ghana and Cote d’Ivoire. Until an international tribunal is able to settle the boundary dispute, which could be sometime in April, Tullow’s operational future there is in doubt.

The FTSE closed at 6,940.64, down 0.1%, with 7,000 still in sight.

Next the NASDAQ

In New York the NASDAQ topped the 5,000 mark for the first time since 2000, reaching 5,001.29 just before noon EST. By 1:30 pm the index had pulled bck to 4,985.23, still up by 0.43% on the day. Because the NASDAQ is so weighted by tech stocks, it does not ordinarily succumb to the same pressures that many other major indices do, particularly mining and energy. Nonetheless, it does ultimately feel the ripples, just as the entire economy does, when the sky is reportedly falling in some part of the fragile global economy.

As of 1:40 pm EST, the NASDAQ has made a turnaround and gained ground back to 4,991.62.

Then there’s the Russell 2000

The Russell 2000, the leading U.S. index of small-cap stocks, has been in a steady climbing mode for the past 30 days, continuing to set new highs over the past week. Today it reached a record of 1,243.33, the highest mark in the index’s history. The purpose of the index is, “To provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.”

While it is not particularly clear how these small caps are being affected by their larger brothers and sisters, these companies can be places for safe-keeping, even if only temporarily for antsy investors in larger-cap companies.

All in all, the week appears to be off to a good start. But you never know what’s coming next.

Hot Features

Hot Features