When Bitcoin debuted in 2009, very few people could have imagined that it would birth a new industry with a market capitalization of close to £300B within a decade. Fewer people would have imagined that Bitcoin could birth a disruption that could potentially end the era of money backed by government sovereignty. Yet, in the last decade, cryptocurrencies have shown that the very concept of money is in a state of constant flux and evolution.

Taking the conversation further to the trading and investment perspectives, cryptocurrencies have mostly outperformed other traditional assets such as equities, commodities, and precious metals in the UK and other jurisdictions. This piece examines some of the reasons you probably haven’t bought cryptocurrencies while providing insight that could assuage your concerns.

FUD is Why You Probably Haven’t Bought Cryptocurrencies

Fear, Uncertainty, and Doubt (FUD) is the deliberate and sometimes, unintentional spreading of news stories that drive despondency and negativity in the cryptocurrency market. FUD often triggers a crash in the price of a cryptocurrency or the general market without any substantiation in technical or fundamental analysis.

One of the biggest reason people are fearful of getting involved with cryptocurrencies is the amplification of news about the loss and theft of cryptocurrencies. Cryptocurrency transactions are fundamentally irreversible; hence, when a cryptocurrency is stolen from your wallet; it is both practically and technically impossible to cancel the transaction to retrieve your coins.

Fear

The fear element of FUD is probably the most devastating market-moving element. The traditional media and social media are often overwhelmed with negative stories designed to propagate fear in the minds of people interested in buying cryptocurrencies. You would have heard too many stories about exchange hacks, private key losses and data breaches.

In 2014, the Mt Gox hack rocked the cryptocurrency market when hackers stole 740,000 BTC (6% of all the Bitcoin mined at that time) valued at about £6.49B in today’s prices. Five years later, none of the customers of the failed exchange have recovered a Satoshi of their lost/stolen BTC. In April, Andy Pag, the founder of Mt. Gox Legal, a firm representing the exchange’s customers has quitted under the realization that users may never find closure.

Earlier this year, Gerald Cotton, founder of Quadriga CX died suddenly leaving its 115,000 users in the dark about the fate of their coins stored on the exchange. An official statement from the exchange observes say it is working hard to “locate and secure our very significant cryptocurrency reserves”. Six months later, the £190M worth of cryptocurrency is yet to be found or recovered.

Managing fear

You can manage the fear of your coins being lost or stolen by purchasing cryptocurrencies from reliable platforms that have a strong history of providing financial services. Coinbase has lowered the trust barrier for U.S. investors and now, Skrill is lowering the trust barrier for investors in the UK and the rest of Europe.

Skill, a global payment solution provider headquartered in London and with operations in the U.S. and Europe is leveraging its expertise and experience in providing financial services to provide users with a provably safe platform to buy and sell cryptocurrencies. Last year, the company launched its cryptocurrency operations and crypto is gradually becoming a part of its core business offering as it continues to utilize its existing rails.

Skrill. A reputable leader of online payment processing extends its roots to cryptocurrencies. A sign of whats to come?

Skrill users can now buy 8 cryptocurrencies; BTC, ETH, XRP, BCH, LTC, ETC, XLM, ZRX, and it plans to add more coins in the coming months. One of the main features of Skill’s cryptocurrency service is its reliable and trustworthy custodianship powered by Paysafe. It also provides an easy Fiat to Crypto gateway that makes it easy to purchase cryptocurrencies with more than 100 secure payment methods while enabling the exchange of cryptocurrencies to more than 40 local currencies for users.

The best part is that Skrill can provide a secure service than other fledging crypto startups because of its experience as a digital payments company with more than £1.56B annual revenues. Hence, it has regulatory obligations to use the industry-grade security that significantly reduces the risk of exchange hacks, private key losses, and data breaches.

Uncertainty and Doubt

Cryptocurrencies are largely regarded as speculative assets; hence, they are subject to a high level of volatility not found in traditional assets. The first market-driven Bitcoin transaction on May 22, 2010, priced 1 BTC at £0.0016 when a £16 pizza was sold for 10,000BTC. Today, 1 BTC about £8,345 marking an incredible lifetime gain of 521,562,400% within 10 years. Bitcoin had its biggest bull run in 2017, starting from around £782 on January 1 and skyrocketing to £16,320 on December 17, 2017, to mark an incredible 1986% bullish ascent.

However, 2018 took a depressing turn that saw the price of Bitcoin and the market cap of the entire cryptocurrency market crashing by more than 70%. The volatility of Bitcoin is often the rallying cry of critics who believe that an asset class with that much volatility will never replace fiat currencies as the future of money.

Bill Harris, founding CEO of PayPal has denounced Bitcoin has a “colossal pump and dump scheme”. Berkshire Hathaway’s Warren Buffet has said “Bitcoin has no unique value at all,” and that it is a delusion that “attracts charlatans”.

Managing uncertainty and Doubt

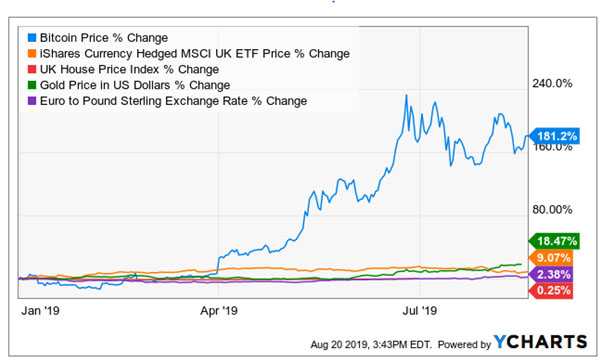

As 2019 gets underway, the cryptocurrency market has witnessed an interesting mix of starts and stops that highlights the volatile nature of the market; yet, the general direction of the market has been indisputably northbound (see chart below).

The volatile nature of the cryptocurrency market might appear to be reckless on the surface; yet, the volatility is the primary driver of profit for investors who get to buy more coins on the dip. More so, the entire cryptocurrency industry is barely 10 years old; hence, the uncertainty is to be expected in an emerging industry. As the industry continues to mature, some of the regulatory uncertainties surrounding cryptocurrencies will yield to certainty and the market will gradually become less volatile.

Final words

Fear, Uncertainty, and Doubt are three key elements that will continue to prevent many people from joining the cryptocurrency revolution. However, the very idea of money has been historically evolutionary. Trade by barter to gold coins, to IOUs notes, to Fiat, and now digital currencies – has shown that money is not a static phenomenon. Hence, cryptocurrency might have a role to play in the future of money even though it is still a long way off from mass-market adoption.

In the words of legendary Wall Street investor, Warren Buffet, you should be fearful when others are greedy and be greedy when others are fearful. The fears about the implications of a cryptocurrency theft provide an opportunity to get a first-mover advantage into the crypto market before it unlocks its mass-market appeal.

Hot Features

Hot Features