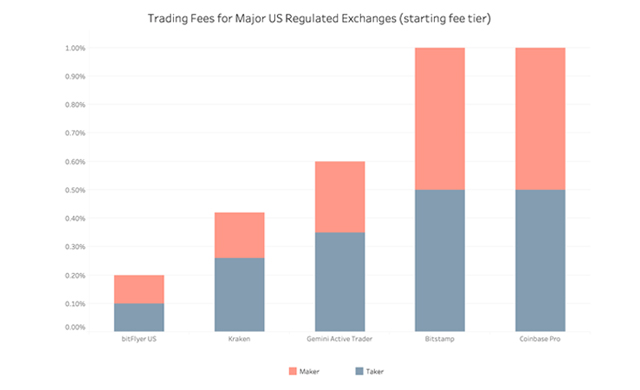

bitFlyer has announced it will drastically cut trading fees on its Lightning exchange, with the highest trading fees beginning at 0.1%, and dropping incrementally as users rack up more trading volume.

The reduction in trading fees is expected to make bitFlyer the US regulated exchange with the lowest fee structure in the country. bitFlyer Lightning is a Bitcoin spot, Futures, FX and altcoin spot trading platform, which also offers up to 4x leverage. Lightning was created by veteran traders on Wall Street, including from Goldman Sachs, and is aimed towards sophisticated traders and large-scale institutional investors.

bitFlyer Reveals a Rate Cut

Starting on November 4, the newly introduced trading structure begins at 0.1% for trading volume of up to and including $50,000 committed over the previous 30 days. The next fee tier drops to 0.09% for volume between $50,000 and $500,000. Trading fees eventually drop to 0.03% for volume of $500,000,000 and over. FX and Futures trading on Lightning is free.

The U.S head of bitFlyer USA, Joel Edgerton, said the decision to drop fees was the most obvious way to add more value to bitFlyer’s customers, and aligns with the platform’s goal of furthering crypto adoption.

“At bitFlyer USA, we always look to add more value to our customers, and the simplest way to do that is to lower fees. We do not have any complicated requirements, allowing customers to simply focus on their trading strategies,” said Edgerton. “It has long been our goal to increase crypto adoption through making bitFlyer the cost-effective, safe alternative for US retail and institutional traders.”

While cryptocurrencies are still not considered legal tender by U.S regulators, the Financial Crimes Enforcement Network (FinCEN) has considered crypto exchanges as legal Money Transmitters since 2013 on the assumption that cryptocurrency tokens represent “other value that substitutes for currency.”

A Japanese Giant Now Big in the US

Although a subsidiary of bitFlyer Holdings, Inc, which is based in Japan, bitFlyer USA received a licence to engage in Virtual Currency Business Activity from the New York State Department of Financial Services, and is legally recognized as a Money Transmitter in a majority of U.S states. The platform gained regulatory approval to move into Hawaii in August, making bitFlyer USA available in 48 states at time of writing.

Yuzo Kano, BitFlyer USA founder and CEO, told Cointelegraph at the time: “Since many Japanese people live in or travel to Hawaii, it is the state that serves as a bridge between Japan and the U.S.”

Notably, bitFlyer recently made strides on the other side of the pond, with the European subsidiary of bitFlyer announcing a fiat-to-crypto bridge using PayPal. The integration of PayPal is expected to make fiat deposits instant, whereas wire or card deposits required between 1-3 days for clearance.

bitFlyer claims to be one of the largest cryptocurrency exchanges in the world, and has processed an estimated $250 billion per year. The platform has an estimated 2 million users worldwide.

Hot Features

Hot Features