Today’s employment data for Australia dispelled any immediate fears of a rate cut. Yet, if a certain correlation is to hold true, we could see unemployment rise and calls for a cut to return with it.

Unemployment ticked higher to 5% (4.9% previously) but as this was in line with expectation, the markets took it within stride and focussed on the positive employment growth and participation rate. The Australian dollar spikes broadly higher, yet struggled to hold onto gain as really, there was nothing monumental about the report overall. Whilst it was ‘okay’, the report served more to dispel fears of a rate cut following RBA’s dovish minutes earlier this week.

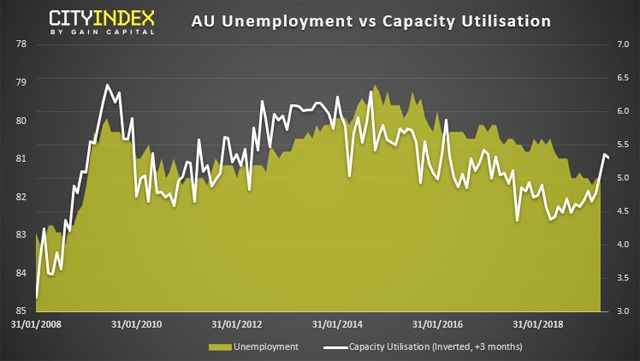

However, there is a correlation between capacity utilisation and the unemployment rate which is worth tracking. It’s not perfect (and they rarely ever are) but, generally their trends track each other over time and capacity utilisation has around a 3-month lead over unemployment. As the correlation is inverted, we’ve flipped capacity utilisation on the chart to better display the relationship. As capacity utilisation has been falling (rising on the chart) since April 2018, it means we should be on the lookout for rising unemployment over the coming months. Remembering that RBA see a rate cut as ‘appropriate’ if unemployment rises whilst inflation remains low, unemployment data could be the one which derails the Aussie if it does indeed begin to rise.

Whilst the market reaction was a little underwhelming, we’re keeping an eye on AUD/CHF as we suspect it may retrace before breaking above the February highs. Sitting near 2-month highs, It’s not uncommon to see prices retrace when they test structural level. Furthermore, price action is currently trading above the upper Keltner band, with an RSI(2) above 90 and currently within its 5th consecutive bullish session. If we close around current levels, tomorrow could present a rikshaw man doji at stretched levels, which is a clear sign of exhaustion. However, given the strength of the bullish leg, we’re looking for a minor pullback before the trend continues.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features