AU Employment Underwhelms | AUD: 69c Defended – Time For A Bounce?

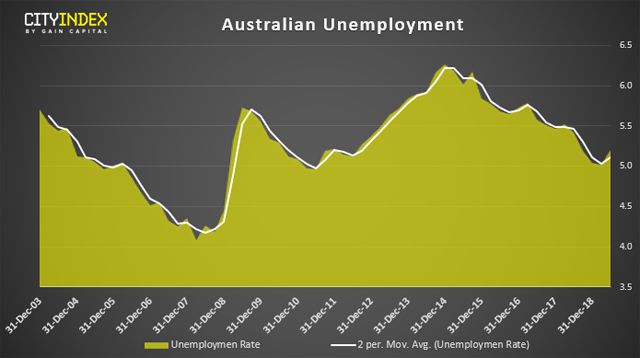

Australian unemployment rose to 5.2%, its highest level since August. Whilst it’s not enough to confirm an RBA cut, there are signs unemployment could rise further at a time RBA are closely watching the sector.

- Unemployment rose faster than expected to 5.2% (vs 5.1% forecast) and is now its highest level since August 2018.

- Employment growth rose 28.4k (vs 14k expected), yet full-time employment declined -6.3k meaning headline growth was driven by part-time employment (+34.7k).

- Still, it’s a volatile number and 12-month average for FT employment is 20.7k versus the 12-month PF average of 6.2k.

- Participation rate matched it all-time high. Yet with rising unemployment, could be driven by people looking for work.

AUD/USD spiked below 69c on the headline data which saw higher unemployment and part-time driven employment growth. However, the higher participation rate may have softened the blow a little, although it’s possible this number has been driven by more people looking for work. Whilst the jury is still out on employment growth (for which RBA remain optimistic) we still think unemployment could rise a little further.

Since the February low, AU unemployment has risen 3 bps to 5.2% which some would consider a trend. Typically, we’d want to see unemployment fall and participation rise, so to see them rise in tandem distorts the optimism higher participation would otherwise bring. And with the unemployment rate at an 8-month high and above its 3-moth average, it’s possible unemployment has seen a trough and could be due to rise further.

At their last meeting, the RBA cited the ‘steady’ unemployment rate of the past six months and that they ‘expected for it to remain around this level over the next year or so before declining to 4.75% in 2020’. Well, what if it continues to rise? There are at least two causes for concern worth monitoring.

- SEEK jobs ads declined 8.9% YoY but to show less demand for employees. Yet more worryingly 24 of the 28 industries saw jobs ads decline this past year. To pick a few, retail and consumer products ads declined -13.2%, insurance and superannuation -19%, banking and financial services –19.4%, real estate & property -21.3% and construction -23.2%.

- Capacity utilisation suggests unemployment could rise to around 5.4% over the next few months

Like traders, the RBA will continue to keep a close eye on employment data. Unemployment is pointing the wrong way, and if we begin to see employment growth falter and participation rate lower, it’s hard to justify the RBA not easing. Especially with stagnant flat wage growth and lower inflation.

For now, we remain bearish below 70c although we suspect AUD could be due a minor bounce given it held above 69c so far today.There’s not a lot of market moving data pencilled in and trade tensions have eased a little, so if stocks extend their rebound then this leaves wriggle room for AUD to lift itself from its lows. If trade tensions resurface and US data comes in strong enough, then a break below 69c appears likely.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features