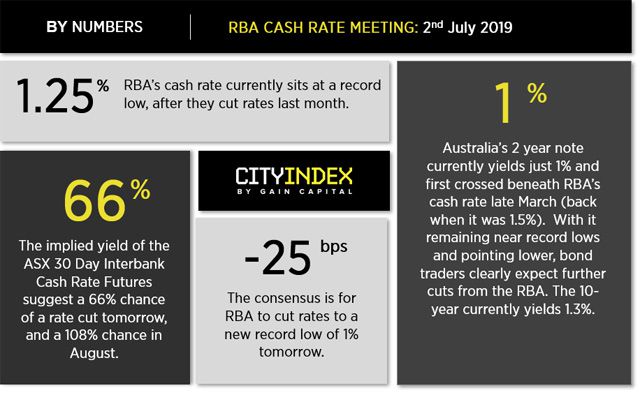

The consensus expects RBA to cut their overnight cash rate (OCR) to a new record low of 1% tomorrow. Yet it could be down to how dovish Lowe is in his subsequent speech as to whether 70c can crash though 70c.

On the 16th June Philip Lowe said it was ‘likely’ RBA would have to cut rates again. According to a Reuters poll, 29 of the 40 economists (72.5%) questioned expect a rate cut tomorrow to 1%. This is slightly above the 66% probability the ASX interbank futures suggest. Either way, the clear majority expect a rate cut tomorrow, but it could be down to how dovish the statement or comments are as to whether it will knock AUD over.

That said, June’s statement lacked a clear dovish bias, and it was comments made later in the day from RBA’s governor Philip Lowe which hammered home the likelihood that further cuts were coming. As it stands, 52.6% of economists poled by Reuters expect RBA’s cash rate to sit at 0.75% by year end. Tomorrow could provide opportunity for RBA to bring some clarity over this likelihood.

In contrast to last month’s meeting, AUD/USD has been mostly rising into the expected rate cut. A dovish Fed has provided the tailwind, although since Powell walked back some of his dovish comments, it’s plausible that the upside potential for AUD/USD could be limited unless RBA surprise markets with a hold or remove their dovish bias (which is unlikely).

AUD/USD has broken back above 70c, although weak PMI data from Asia has seen it wobble at the highs and test this key level. At the time of writing, AUD/USD is on track for a dark cloud cover pattern (with a bearish engulfing candle) at the highs ahead of tomorrow’s meeting. If we’re to see a dovish cut, we’d expect AUD to trade comfortably below 70c by the end of the session.

Given the 100-day moving average is capping as resistance, and structural highs are nearby at 0.7048 and 0.7069, the reward to risk potential appears more favourable to the bear camp. Just as long as the RBA deliver a dovish cut. And, once again 70c appears pivotal around RBA’s highly anticipated meeting.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features