Weekly COT Report: USD Long Exposure Drops To A 3-Month Low

As of Tuesday 16th of July:

- Net-long exposure for USD hit a 13-month low at $11.66 billion ($16.4 billion against G10)

- Traders are their most bullish on CAD futures since March 2018

- Sterling traders extend net-short exposure to a 10-month high

- FX majors weekly changes were below 10k contracts, with CAD being the exception which increased long exposure by +11.7k contracts.

USD: Considering dollar bulls have slashed their exposure by around 66% since May, the dollar is holding up surprisingly well (both DXY and TWI). That would suggest either speculators or price action is incorrect, meaning we could be in for a directional move (whether it be one catches the up, or meet somewhere in the middle). The main USD debate this month is whether the Fed will cut by 25 or 50 bps, so any US data or comments by Fed officials will be rightly scrutinised to keep USD in full focus.

CAD: Last week we noted that CAD’s 1-year Z-score was above +2 standard deviations which, historically, acted as a warning to a top in net-exposure and price action. However, upon closer inspection, we note that it (famous last words) ‘be different this time’ because the long/short ratio is just 1.3:1, whereas the prior two Z-score warnings saw a long/short ratio of 3:1 and 4.8:1. Moreover, net exposure has only recently flipped to net-long and is bar no means high by historical standards. Still, using other metrics we note that CAD’ CESI index appears overly optimistic and USD/CAD is trying to build a base around 1.3, so a near-term correction is not off the cards before our core bullish bias for CAD plays out.

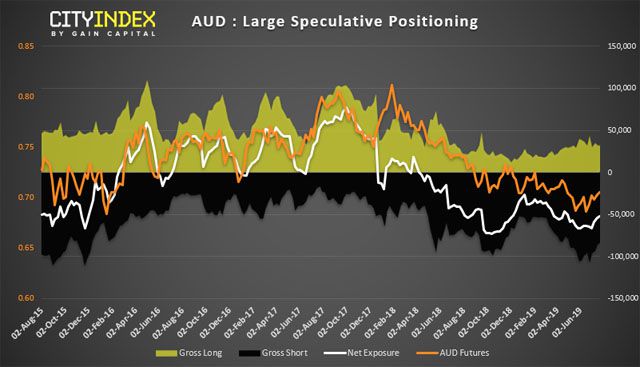

AUD: I felt compelled to put AUD up today as it’s not been up for a while. But, ultimately, it’s hard to get too excited over as positioning appears rather directionless by some metrics. In recent week’s we’ve seen both gross longs and shorts trimmed, although this has allowed net-short exposure to rise to its least bearish level in 3-months. However, the long/short ratio has essentially flatlined this year and remained around 0.3:1. Hardly a strong bull-case.

JPY: The swing on net-exposure have been very cyclical of late, and the peak we suggested last week appears to be playing out. Which could suggest a period of risk-on behaviour. Which is interesting, given weak global data, the potential for a 50bps Fed cut and stocks just off record highs. Still, the data is what it is; short interest is picking up and long interest is dwindling, even if only moderately so.

As of Tuesday 16th of July:

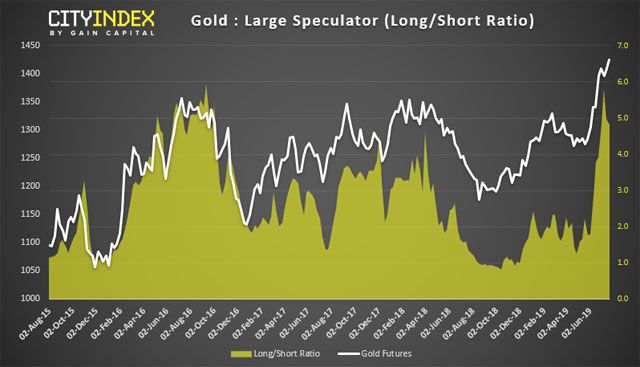

- Gold bugs pushed their net-long exposure to an 18-month high

- Traders were net long at their most bullish level on Silver in 4-months

- The weekly change for TWI was its most bullish change in 3-months

- Net-long exposure for platinum hit a 9-week high

Gold: Gold bugs pushed their exposure to a new high, albeit by just +738 contracts. Which does little to sooth concerns about stretched prices by some metrics. Admittedly, the long/short ratio has dipped lower yet remains historically high at 4.83 (4.99 prior) and the 1-year Z-core is +2.28 standard deviations. A particularly dovish Fed has been the main catalyst in recent weeks, so we expect volatility n gold to remain in the lead up to the Fed’s meeting on 31st of July as officials verbally guide expectations. Where perhaps clues of a 25bps hike over a 50 could spark a correction.

Silver: Like gold, silver is rallying at break-neck speed. Unlike gold, positioning is not screaming over-extension. Prices have just broken to a YTD high, the long/short ratio is a modest 1.59 (versus 4.83 for gold) and we’re seeing a steady rise of long and culling of shorts.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features