The Bank of Japan will buy an unlimited amount of government bonds and purchase up to a sixth of corporate debt in response to the coronavirus pandemic.

The central bank signalled that it would intervene as it needed to soak up higher bond issuance by the government and keep interest rates low.

The pledge of unlimited government bond purchases may have little practical impact, however, with the central bank already buying far less than its previous cap of ¥80trn a year.

The bank has not needed to buy the full ¥80trn to keep yields at zero and had been debating whether to scrap the pledge even before Covid-19. However, removing the cap now could mean a willingness to buy more bonds rather than less.

Japan’s journey back into deflation this year will mark the defeat of governor Haruhiko Kuroda’s campaign to end falling prices. The BoJ expects prices to drop by 0.6 per cent in the fiscal year to March 2021, excluding the impact of last year’s consumption tax rise, before turning positive the following year.

The BoJ cut its growth prediction for the current fiscal year to a range of -3 to -5 per cent. After a modest increase in corporate bond buying in March, the BoJ increased its maximum purchases of corporate paper to ¥20trn ($186bn) until September 2020.

The BoJ will also make it cheaper and easier for commercial banks to borrow by expanding the eligible collateral to include private debt in general.

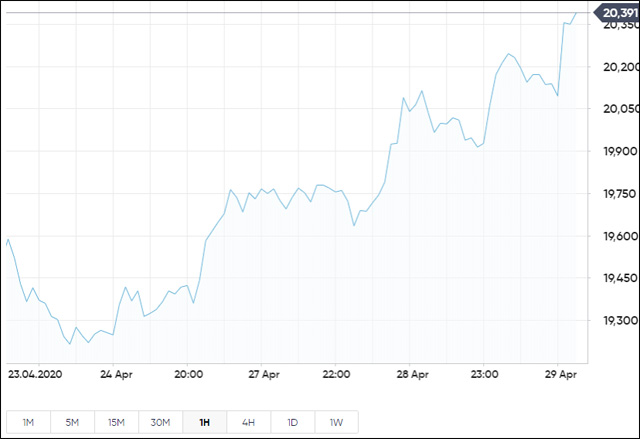

Trade Japan 225 – J225 CFD

Hot Features

Hot Features